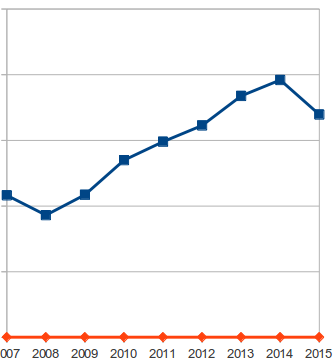

I've been ER'd for 13 years now. This is only the second time in all those years that my portfolio shows a lower balance at the end of the year than at the beginning ( I live off my portfolio except for SS started 3 years ago at 62). The loss in 2008 was 12 times greater than the loss this year so I shouldn't complain too much. It just feels kind of weird to see it go down. I guess I just got used to those NW lines that go up and up on the right hand side of the graph...

No, not changing allocation and doing much of anything other than having a nice glass of wine and wishing all a Happy New Year!

No, not changing allocation and doing much of anything other than having a nice glass of wine and wishing all a Happy New Year!