Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

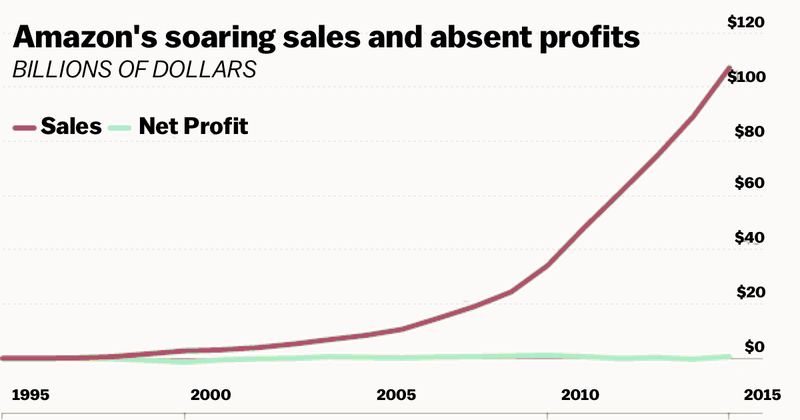

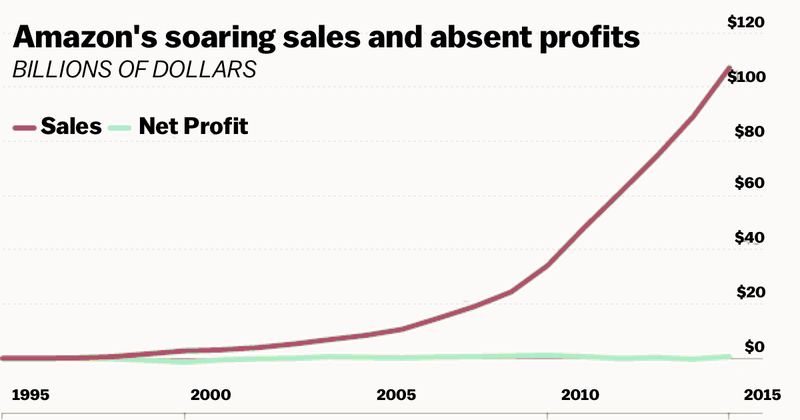

Sales and profits are charted below for the 6th largest US company by market cap.

The P/E is positive for a change (hurray!) at about 800 to 1, according to one stock page.

The same page shows a price to book of 25 to 1.

I'm glad AMZN is only about 1.5% of my S&P index fund. At some point, the Bezos mystique will fade and the market will price Amazon more realistically.

The P/E is positive for a change (hurray!) at about 800 to 1, according to one stock page.

The same page shows a price to book of 25 to 1.

I'm glad AMZN is only about 1.5% of my S&P index fund. At some point, the Bezos mystique will fade and the market will price Amazon more realistically.