The Average American Household Approaching Retirement Has This Much Saved Up -- The Motley Fool

Sent from my iPad using Early Retirement Forum

Sent from my iPad using Early Retirement Forum

The 59% who have saved

The financial situation of this group was a much wider range, with 7% having less than $10,000 and 9% have more than a half-million dollars. Of this group:

- The median net worth per household is $337,000.

- 87% are homeowners, but only 27% own their home outright.

- 45% have a defined benefit plan.

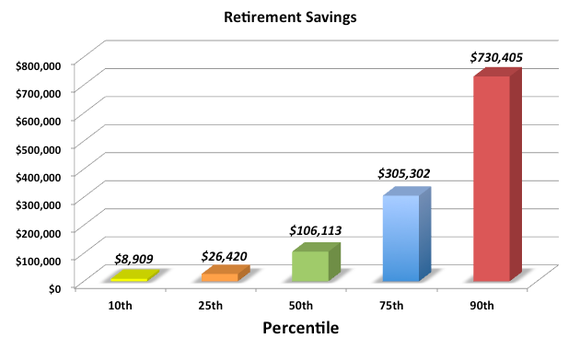

For those who are competitive, the authors also took into account all of the households with some retirement savings, and broke them down into percentiles. As a refresher, being in the 10th percentile means you have a nest egg bigger than 10% of all those with some saved up; the 90th percentile means you have more than 90% of those with some savings.

Here's how it all shook out.

The title is inaccurate. The average is not the median. $106,000 is the median.

I fixed the grammar, I think? If it isn't what you meant to say, then just contact me or any mod or admin and we can change it to what you meant.MichaelB. That is a lot to ask of someone posting on treadmill! Witness bad grammar in title!

The way I see this, at least 3/4 of the population of imminent retirees don't have much, if any, retirement savings. We of this forum would like to think that this is not our problem. For a while, I think it is unlikely to be our problem. However, eventually, if there is some sort of Arab spring here, it might become our problem. I hope it doesn't come to that. ....

To say the median is not average, is being mean.

Statistical humor! Love it - thanks for the laughBut that often is the mode around here.

I fixed the grammar, I think? If it isn't what you meant to say, then just contact me or any mod or admin and we can change it to what you meant.

The way I see this, at least 3/4 of the population of imminent retirees don't have much, if any, retirement savings. We of this forum would like to think that this is not our problem. For a while, I think it is unlikely to be our problem. However, eventually, if there is some sort of Arab spring here, it might become our problem. I hope it doesn't come to that.

Note this information is based on survey taken by our Federal Government. I'd guess most of us have a certain amount of distrust in our government...

If we end up in some kind of violent revolution then it will suck for everyone - an even better argument to enjoy ER now while we can.

Anyone can lie on a survey. I put more faith in the 401K/IRA retirement saving account numbers reported by Fidelity.

I do too, but only with the realization that "account value" is less than "amount of retirement savings". Account value skews low because many people have multiple accounts. How many retirement accounts do people have on average? That's a number I've not seen accompanying results of such reports.

As I grow older I have become more trusting of govt. It's the population I have lost faith in.