My Brexit thoughts

Continuing personal thoughts and observations on The UK exit from the EU.

Leave 52%.. Stay 48%

Turnout 33 million voters (US 2012 133Million)

66% of eligible voters (US 2012 62%)

Word Cloud for Leave... top Score "Immigration"

Word Cloud for Stay... top score "Economy"

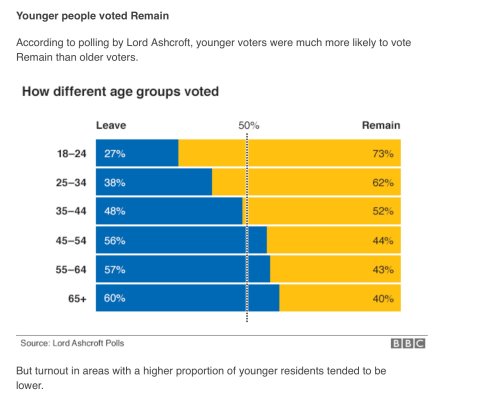

Older Voters "Stay"

Younger Voters "Leave"

Current "revote" signatures... No legal action supported. 3 Million signatures to overturn results ? Unlikely

Voter Breakdown:

EU referendum: The result in maps and charts - BBC News

Wiki explanation of UK Parliament:

https://en.wikipedia.org/wiki/Parliament_of_the_United_Kingdom

Conservative - David Cameron (resigned)

Labour - Jeremy Corbyn (current support in question)

Other parties (outlined by Wiki) left/right/center leaning:

https://en.wikipedia.org/wiki/List_..._United_Kingdom#Register_of_Political_Parties

Central Banks...No mandate for economic support, but historically likely. Short term stabilizing results, but longer term questionable. Could cause longer recovery period.

Typical investment management involves company ratings. The EU took much of the comparative dollar value out of the equation. Going back to individual country dollar values may complicate financial advice.

Global equities markets had a $2 Trillion Market Cap Drop. The health of the EU Country economies will come into play as markets rebalance. Internationally, the same uncertainty may delay and a return to stability. Brexit adds $380 Billion to the Global Bond Yield worries.

Negotiations UK/EU:

Look to be fiery for a few days. Balance of trade, likely to be the heart of the ongoing instability in the short term. All trade agreements will be have to be renegotiated. UK should have the edge based on the import/export ratio.

The lingering question is what, if anything will happen in the matter of immigration, jobs, and the concentration of wealth that triggered the initial vote. Similar political concerns exist, not only in the EU, but worldwide. But we won't go there.

You are definitely right.. I do know better...

You are definitely right.. I do know better...