ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

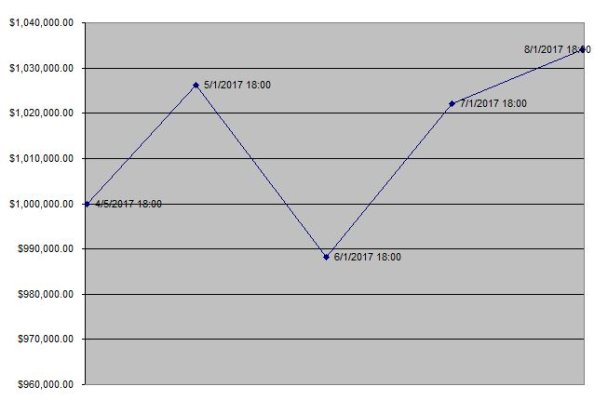

Can you post an update for us gawkers? - ERD50

It's been about 4 weeks since the last screenshot was posted. Can we get another update please? I'm actually following some of the stocks mentioned here closer than I do my own (boring broad-based index funds). Not trading them though.

-ERD50