Hi All

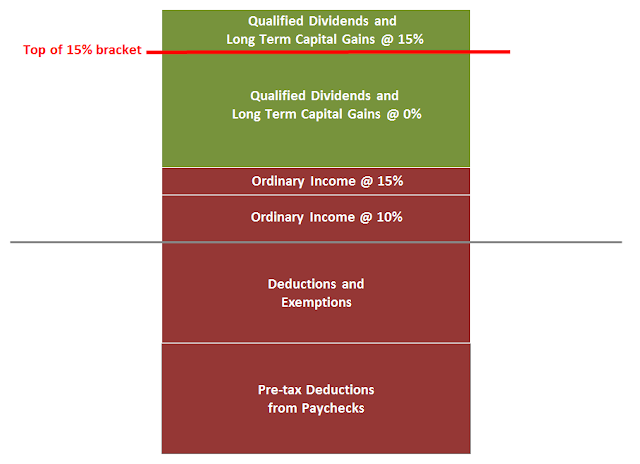

Married filing jointly I know under $75,300k income equals zero capital gains tax and above $75,300k would trigger 15% capital gains tax.

If you had capital gains income (no other income) above $75,300 are you taxed at 15% for all of the capital gains or only the portion above the $75,300?

phil

Married filing jointly I know under $75,300k income equals zero capital gains tax and above $75,300k would trigger 15% capital gains tax.

If you had capital gains income (no other income) above $75,300 are you taxed at 15% for all of the capital gains or only the portion above the $75,300?

phil