audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Somehow I missed this gem of an article from Kitces comparing the total return holding a bond to maturity versus a reinvesting constant maturity bond (acting like a bond fund) during rising rates.

When Kitces wrote this two years ago, the 5 year treasury was at 1.75%, and the Fed hadn't started raising raising rates. The 5 year treasury has made it to a little over 2.1% now, and the Fed has raised interest rates 0.25% three times and is expected to do a fourth raise this month. The yield curve has flattened, so short-term rates have increased quite a bit more than intermediate rates, and long-term rates have dropped.

A lot more good stuff in the article: https://www.kitces.com/blog/how-bon...ve-help-defend-against-rising-interest-rates/

When Kitces wrote this two years ago, the 5 year treasury was at 1.75%, and the Fed hadn't started raising raising rates. The 5 year treasury has made it to a little over 2.1% now, and the Fed has raised interest rates 0.25% three times and is expected to do a fourth raise this month. The yield curve has flattened, so short-term rates have increased quite a bit more than intermediate rates, and long-term rates have dropped.

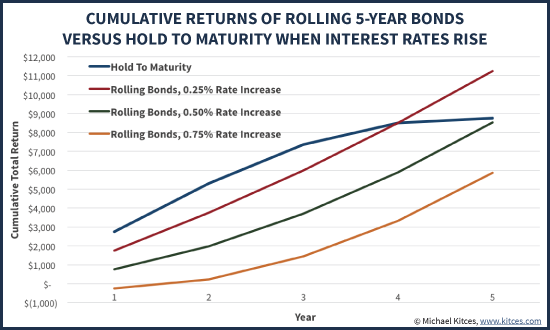

So how much of an interest rate increase does it take for the two to offset? As the graphics show below, even if rates increase an average of 0.25%/year – returning to 3% yield on the 5-year Treasury by the end of the decade – the investor still has a better cumulative return by rolling the bonds. In this case, the price decline from rising rates effectively offsets the price increase from rolling down the yield curve, but the investor still gets to keep reinvesting at higher yields, producing more total return. At a 0.50%/year rate increase – pushing the 5-year to 4.25% by the end of the decade – the scenarios come out the same, as the small annual price losses that are recognized by rolling the bonds in rising rates are offset by the higher yields obtained by reinvesting into new bonds. If rates rise at a more ‘extreme’ rate, by 0.75%/year – putting the 5-year Treasury at a whopping 5.50% by the end of the decade, a yield it hasn’t seen since the year 2000(!) – the investor still has a positive total return, at just a slight loss to the buy-and-hold investor.

Cumulative Returns Of Rolling 5-Year Bonds Vs Holding To Maturity As Interest Rates Rise [X% per year over five years]

As the results show, there is a point at which rising rates will make it unfavorable to hold a bond fund over just sitting on individual bonds until maturity. However, the required magnitude of rate increases must be quite significant – even a scenario where rates rise fast enough in the next 5 years to offset all the rate decreases of the past 15 years (back to 2000!) still only results in a slight loss of total return compared to just buying and holding the bonds!

A lot more good stuff in the article: https://www.kitces.com/blog/how-bon...ve-help-defend-against-rising-interest-rates/

Last edited: