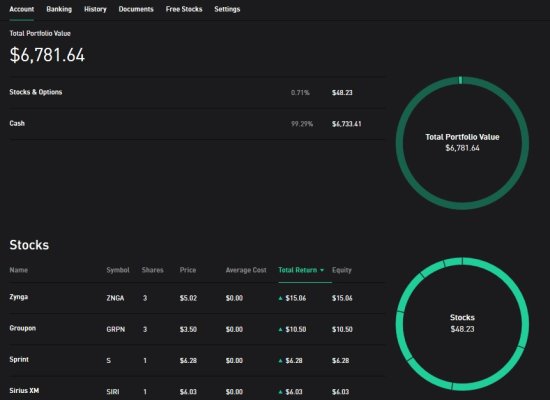

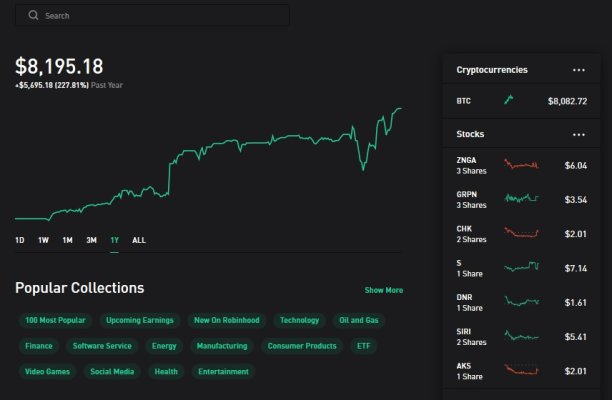

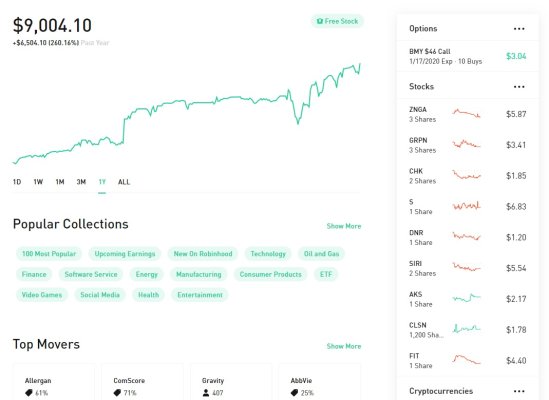

As mentioned in post #43 above, I likewise did this and it has similarly been going quite well - but again, I don't do options, so no way I am keeping up with Fermion. As I've grown more confident, I've still kept my transaction sizes small - scale in, scale out. I haven't utilized more than 40% of my bankroll at any point in time thus far. In the 3 months, I've done 639 trades! My strategy is like penny-ante poker - simply working off of normal volatility in the shares. I have no particular desire to "invest" long term (I have my other accounts for that) - here, I'm in, small gains, out. As I build up the balance further, then I'll look to begin to look at increasing the trade size.

Just to get it out of my system, about 2 months ago, I did buy $5 worth of bitcoin, and then the next afternoon sold it for 20 cent profit. I've done it, and had a profit, I got my adrenaline rush, and I feel good/lucky. No desire to do it again.

The trade executions have been very good - I watch them through Fidelity's platform, and am able to see that I am getting the pricing I expect or better.

I would highly recommend everyone try it - even if opening a small account. It allows you to do what you would never consider doing if you were paying commissions - and that's how I utilize it, exploiting what they are offering.

In my younger days, 25 years ago, when e-Commerce was still nascent, I started a business where our primary supplier began offering free shipping if we would enter our orders electronically to them. The business approach quickly evolved to how much order volume we could generate, even at cost, because our profit was guaranteed on a per order basis to be at least what we were charging for shipping. As a result, we were extremely competitive, and having our supplier drop ship, handling the packing and shipping all for free was tremendous. I see Robinhood similarly - they are giving a free ride for the transaction costs, so the approach can "devolve" into how much order volume you can generate and how high your portfolio turnover rate can be. You can't do this with traditional brokers, because minimally you have your $4.95 to buy and then $4.95 to sell - so you have to generate a profit of at least $9.90 before you have anything to show for it.