ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In this months AARP Bulletin there is an encouraging editorial about Social Security. They list 12 Fun Facts about SS.

Here are some highlights (Not All):

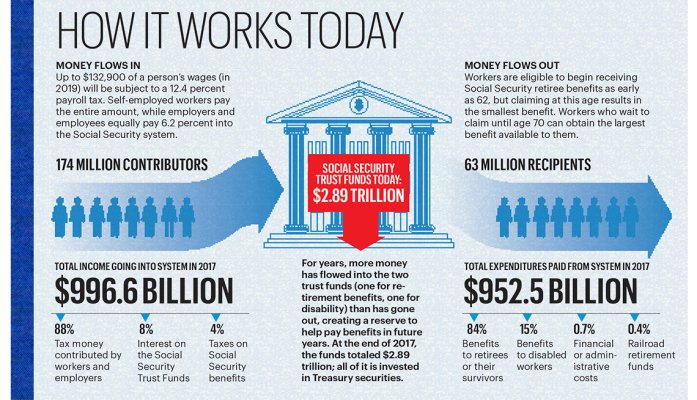

1) Social Security is NOT Going Bankrupt

2) Congress will probably not take up SS Reform Any Time Soon

4) Lawmakers do NOT raid the Trust Fund

12) Most people get more back than they put in.

Those are the ones that caught my eye, you will find the whole section on Page 8 of the Publication. There may also be more info on their AARP Web Site. https://www.aarp.org/retirement/social-security/

Here are some highlights (Not All):

1) Social Security is NOT Going Bankrupt

2) Congress will probably not take up SS Reform Any Time Soon

4) Lawmakers do NOT raid the Trust Fund

12) Most people get more back than they put in.

Those are the ones that caught my eye, you will find the whole section on Page 8 of the Publication. There may also be more info on their AARP Web Site. https://www.aarp.org/retirement/social-security/