JackJester

Recycles dryer sheets

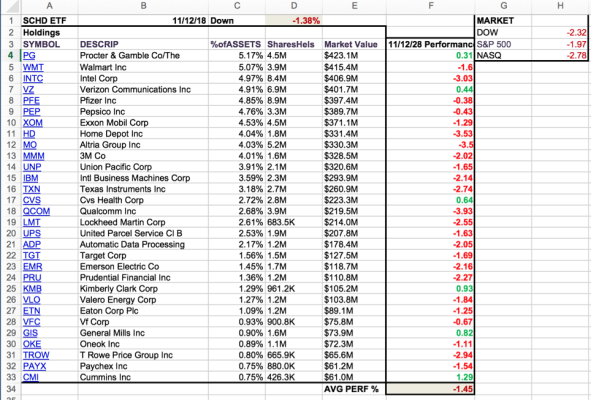

I have always wondered if it is better to own an ETF in a particular category vs owning the individual stocks of that ETF in your portfolio. In particular, I am focussed on Dividends, and I own a good amount of Schwab U.S. Dividend Equity ETF (SCHD). I always wondered if the majority of owners of the ETF actually focus on the holdings of that ETF vs simply buying or selling based on the overall momentum of the market. So, today, with markets down sharply, I crunched some #s. In the picture I show that SCHD was down -1.38% today, and the average performance of the ETF’s top 30 holdings was nearly equivalent (down -1.45%). I have thought about building my own dividend portfolio, but right now I question its benefit vs simply owning the ETF. While this is only 1 data point, does anyone know if there are data out there that track an ETFs performance over time vs the ETF’s indivdual holdings? IOW, does an ETF out-perform, equal, or under-perform its holdings? Sorry if this is a stupid question, please educate me

Jack

Jack