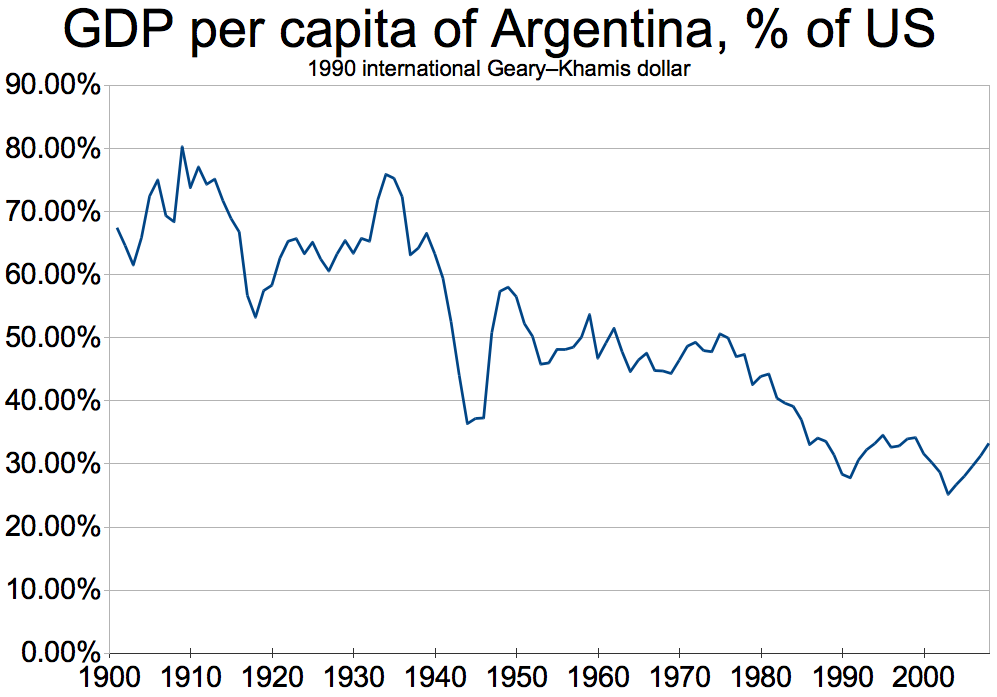

No doubt you've read about the situation in Argentina. While most here are not deep into international bonds, there are 196 countries that the US recognizes. Almost all are involved in debt, backed by bonds. We don't often hear of this as most portfolios are not based in high risk bonds, but the world market is involved, and indirectly, part of the national debt/income too.

An interesting subject, currently in flux, but soon to be forgotten. You might be interested in this June 2017 article that dealt with Argentina, and previous defaults.

https://www.ft.com/content/5ac33abc-551b-11e7-9fed-c19e2700005f

Maybe a reason to notice comparative debts involving other countries in the financial news, as well as U.S. Corporations.

edit ... oops.. the article may be behind a firewall (Financial Times). There will be many articles about the same subject. The articles reviewed previous bankruptcies.

An interesting subject, currently in flux, but soon to be forgotten. You might be interested in this June 2017 article that dealt with Argentina, and previous defaults.

https://www.ft.com/content/5ac33abc-551b-11e7-9fed-c19e2700005f

Maybe a reason to notice comparative debts involving other countries in the financial news, as well as U.S. Corporations.

edit ... oops.. the article may be behind a firewall (Financial Times). There will be many articles about the same subject. The articles reviewed previous bankruptcies.

Last edited: