I checked DW's SPD just for kicks, since I'm planning to rollover to an IRA after the last company contribution. They had a pretty ambiguous paragraph about separating at 55, though no other words about it in the normal withdrawal section.

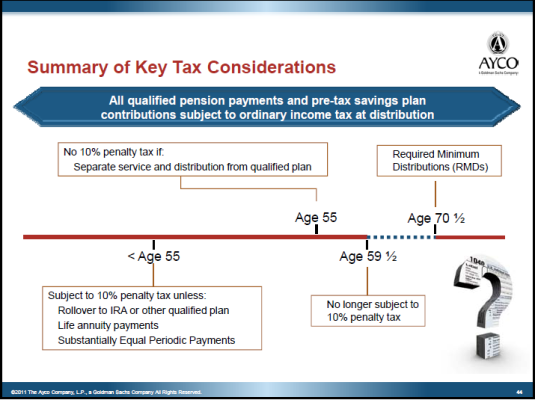

The weird thing I encountered was that she can't withdraw the company contribution until age 70 or 70.5, I forget which. I've never heard of that kind of a restriction before. It didn't apply to simple rollovers. There were also restrictions on how many withdrawals she could take per year (one or two depending on type). Not terribly convenient if you wanted to change your withdrawal every month.

The weird thing I encountered was that she can't withdraw the company contribution until age 70 or 70.5, I forget which. I've never heard of that kind of a restriction before. It didn't apply to simple rollovers. There were also restrictions on how many withdrawals she could take per year (one or two depending on type). Not terribly convenient if you wanted to change your withdrawal every month.