You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Vanguard 2014 TurboTax Downloads Available w Discounts

- Thread starter Midpack

- Start date

If you have capital gains or losses (Sch D), you now need their Premier version which is $10.Maybe someone else posted and I missed it, but I just downloaded 2014 TT Deluxe for free! So I can start tweaking my year end taxable income. Best of luck...

Steelart99

Recycles dryer sheets

- Joined

- Apr 24, 2012

- Messages

- 184

Grumble, grumble. I have a VG account ... but have been buying TT for years .... didn't know I could get it for "free"

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

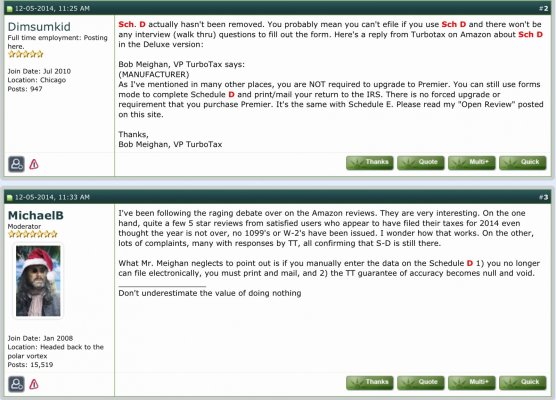

Correct for most intents and purposes. Based on the thread here a few days ago, evidently it's still there in form version, but you can't eFile it, so you have to print/mail in Sch D. That's a PITA!If you have capital gains or losses (Sch D), you now need their Premier version which is $10.

Attachments

meierlde

Thinks s/he gets paid by the post

So you can't e-file (with schedule D) but it is still part of the program and included in the interview portion and taken into account for tax calculations?

Delux includes in the forms mode the worksheet the capital gains worksheet that asks for all the information. The other thing delux apparently can't do is an import from other souces as you have to type the data in.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

While I normally use forms mode, to be able to import and efile is well worth the $10 to me.

I just looked online at Vanguard (w/o signing in) and it appears that Deluxe is free to Flagship and Asset Mgt Svcs clients, or $49.99 for all others. Premier is $9.99 for Flagship - $74.99 all others (referencing all desktop download versions - online version is less)

Edit: logged in for grins and it's still the same pricing as above (am Flagship and pricing is free, so don't know if other VG clients are free as well when signing in now).

I've downloaded the Deluxe version from Vanguard and started inputting data. It takes input for Capital Gains as long as they were not as a result of sales (it will tell you to upgrade to Premier for actual sales). This is allowable with the Basic and Deluxe Desktop versions (Schedule D is not required for gains earned w/o actual sales or losses). I posted this in the previous thread on this subject.

The Fed Deluxe version is not complete and won't be complete until 1/8/15 - ready for efile (update notice after getting available updates).

Edit: logged in for grins and it's still the same pricing as above (am Flagship and pricing is free, so don't know if other VG clients are free as well when signing in now).

I've downloaded the Deluxe version from Vanguard and started inputting data. It takes input for Capital Gains as long as they were not as a result of sales (it will tell you to upgrade to Premier for actual sales). This is allowable with the Basic and Deluxe Desktop versions (Schedule D is not required for gains earned w/o actual sales or losses). I posted this in the previous thread on this subject.

The Fed Deluxe version is not complete and won't be complete until 1/8/15 - ready for efile (update notice after getting available updates).

Last edited:

While I normally use forms mode, to be able to import and efile is well worth the $10 to me.

+1

When I used to maintain my house and car I always believed in buying the right tools for the job, and it is the same here, for me. I'm prepared to pay $10 to save inconveniences and work-arounds but I respect others' decisions to take a different approach.

Each to his own.

KB

Thinks s/he gets paid by the post

Where can I download Turbotax on the Vanguard site? It prompts me to start inputting online and I want to download it to my laptop. Thanks.

Where can I download Turbotax on the Vanguard site? It prompts me to start inputting online and I want to download it to my laptop. Thanks.

When you go to the VG website and sign-in, you go to the TurboTax website through them with their link. IIRC - below the sign in/start your taxes online is the area where you select the Desktop download. It should price out at VG pricing if you went to the website through VG.

KB

Thinks s/he gets paid by the post

Thanks fritz. I'll try that.

Linney

Recycles dryer sheets

- Joined

- Nov 24, 2006

- Messages

- 321

Where can I download Turbotax on the Vanguard site? It prompts me to start inputting online and I want to download it to my laptop. Thanks.

I found these tips posted on Bogleheads.org to be quite useful:

Downloading TurboTax - tips for an easy process

SteveNU

Recycles dryer sheets

- Joined

- Feb 19, 2010

- Messages

- 416

If you want the disc version or download Amazon has it for the same as or less than Vanguard if you aren't flagship. I take advantage of the %10 bonus they offer so it ends up basically paying for itself if you put $500 of your refund towards an Amazon gift card.

easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

I found these tips posted on Bogleheads.org to be quite useful:

Downloading TurboTax - tips for an easy process

The cynic in me says that Intuit purposely made navigating to the download so difficult so we'd give up and just buy a version at a higher price.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

You guys just saved me some money!

I thought VG was online only. I don't like the online version.

Thank you!

I thought VG was online only. I don't like the online version.

Thank you!

Be really careful about the online version! Turbotax allows anyone who knows your name, address and SS# to pull up your tax return. This allows them to know your real sources of income and more easily file a phony return the next year or amended return that doesn't get flagged.

I found this out the reverse way -- somebody last spring filed a phony return for me using turbotax online, knowing only my name/address/SS#. It got flagged by the IRS because it didn't match up with my income sources. I then went to Turbotax to do my actual return and when I tried to sign up it said I already had an account under that SS#. I clicked on "forgot login" and it only asked name/address/SS# and let me in. I then had full access to that return. If they were the real me and I was the criminal, I now can see and amend the return.

Don't trust putting your data on "the cloud"!

I found this out the reverse way -- somebody last spring filed a phony return for me using turbotax online, knowing only my name/address/SS#. It got flagged by the IRS because it didn't match up with my income sources. I then went to Turbotax to do my actual return and when I tried to sign up it said I already had an account under that SS#. I clicked on "forgot login" and it only asked name/address/SS# and let me in. I then had full access to that return. If they were the real me and I was the criminal, I now can see and amend the return.

Don't trust putting your data on "the cloud"!

mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Don't trust putting your data on "the cloud"!

Do you think that Bureau 121 has access to Cloud Data?

BellBarbara

Recycles dryer sheets

- Joined

- Oct 17, 2010

- Messages

- 392

OK totally strange. I went to download the TT via the Vanguard website but could not get the discount. Could not figure out what is wrong. My husband discovered we were flagged at Voyager customers, not Flagship, despite having way more than required to qualify. Apparently you have to ask them to submit you for approval. This seems lame to me on Vanguard's part. My husband just called them and they are submitting us - but it takes anywhere from 2 - 7 business days. This is the first time I have been disappointed in Vanguard.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

Barbara, I had to ask too. Did it last summer.

I'm guessing that with the market run up, a lot of people now qualify so they want you to make the first move.

Agree that one would hope it is automatic. But apparently it isn't.

I'm guessing that with the market run up, a lot of people now qualify so they want you to make the first move.

Agree that one would hope it is automatic. But apparently it isn't.

BellBarbara

Recycles dryer sheets

- Joined

- Oct 17, 2010

- Messages

- 392

Oh thanks for confirming it happened to you too. We are way over, like double, and we just moved everything to them about a year ago (from Fidelity). So you would have thought they would have set it up then. I don't think we knew the difference.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

I'll say this. Now that we were "promoted", they've been really helpful.

I wanted to move all my stuff from E*Trade to VG brokerage. It took all of 10 minutes over the phone, with an electronic signature online. Done. They did all the heavy lifting and got it all correct.

I wanted to move all my stuff from E*Trade to VG brokerage. It took all of 10 minutes over the phone, with an electronic signature online. Done. They did all the heavy lifting and got it all correct.

BellBarbara

Recycles dryer sheets

- Joined

- Oct 17, 2010

- Messages

- 392

Yes it was a bit of a chore for us to sell/buy everything we moved over. They were pretty much no help, other than they offered us a person in a call center to just say it all out. (sell this buy that). We did not feel comfortable doing that as there were so many transacations. We were bringing over 4 accounts......I guess because we did not want to hire the advisor, we were left to do it ourselves. My husband did it OK, but we thought with the amount of money, there should be more service.

We are still happy we moved (from Fidelity).

We are still happy we moved (from Fidelity).

Similar threads

- Replies

- 19

- Views

- 799

- Replies

- 5

- Views

- 672

- Replies

- 5

- Views

- 604