Lisa99

Thinks s/he gets paid by the post

- Joined

- Aug 5, 2010

- Messages

- 1,440

I'm stumped... googled, looked at TurboTax FAQs and still can't figure this out so I hope someone here can help.

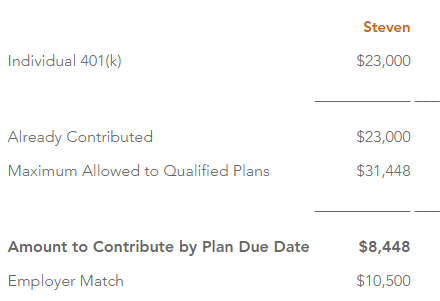

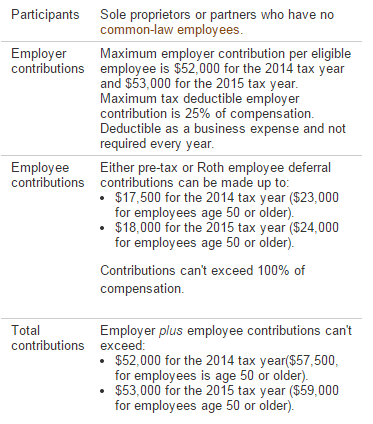

DH started an independent consulting company this year. He has no employees. I opened him a solo 401k in Vanguard and funded it with $23k contribution and $10,5k employer match (which I thought was close to the max he'd be able to contribute based on net income).

But as you can see in the screen shot below from Turbo TurboTax shows that we can fund it with more than $40+k in total this year.

What am I missing?

DH started an independent consulting company this year. He has no employees. I opened him a solo 401k in Vanguard and funded it with $23k contribution and $10,5k employer match (which I thought was close to the max he'd be able to contribute based on net income).

But as you can see in the screen shot below from Turbo TurboTax shows that we can fund it with more than $40+k in total this year.

What am I missing?