DROPOUT

Recycles dryer sheets

Hey Guys,

Signed up on the SS.gov site to find out my benefit information. I have amassed my 40 credit I guess you would call them?

I'm currently 30 yrs old, planning to retire by 40 (fingers crossed ofcourse)

I'm not necessarily holding my breath that we will still have SS available to us when we become of age, but, I figured, I'd go ahead and account for it just in case.

With that said ~ How do you account for benefits when you retire early?

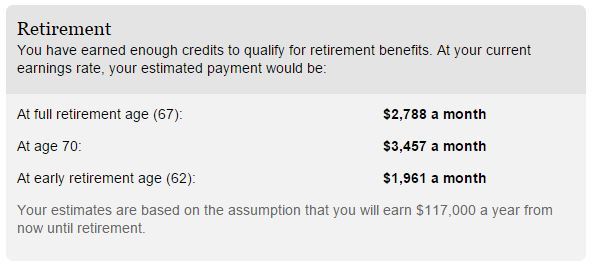

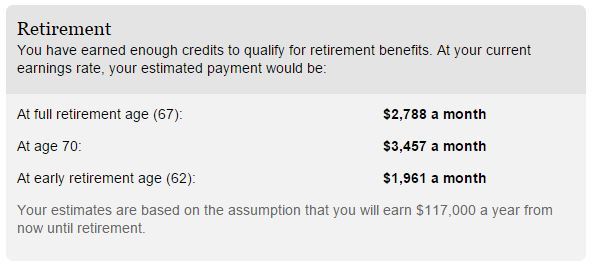

This is what I currently see when I log in:

Assuming I do retire at 40 ~ I will not be making the $117k/year required for those benefits. How would I calculate what I might actually receive?

Thanks y'all!

Signed up on the SS.gov site to find out my benefit information. I have amassed my 40 credit I guess you would call them?

I'm currently 30 yrs old, planning to retire by 40 (fingers crossed ofcourse)

I'm not necessarily holding my breath that we will still have SS available to us when we become of age, but, I figured, I'd go ahead and account for it just in case.

With that said ~ How do you account for benefits when you retire early?

This is what I currently see when I log in:

Assuming I do retire at 40 ~ I will not be making the $117k/year required for those benefits. How would I calculate what I might actually receive?

Thanks y'all!