...

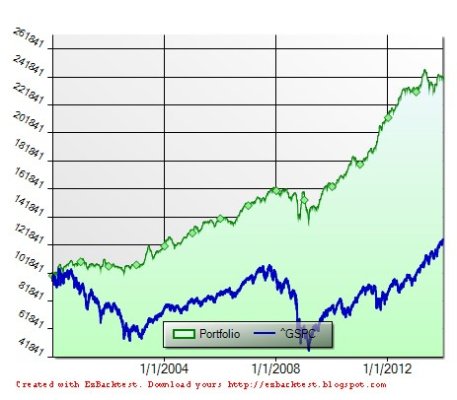

But here's the most interesting point. At the end of 2011, FIRECalc shows that the 50/50 blend of Total Stock/Long Treas portfolio balance would be $714K in nominal dollars (see earlier post), while my spreadsheet shows $1183K. That's a big difference!

The answer to the $469K question is next.

Here's the thing I've found with FIRECalc.

When I started this thread, I was simply looking to explore further the unfortunate fate of our "Hapless Y2K Retiree" as Raddr first exposed the situation on his site. As Raddr used short-term commercial paper for the bond portion, and then only 25% at that, I was curious to see how a bit more fixed income and those of a different type would help. And I used FIRECalc for the results shown in the beginning of the thread. It was simply bleak, bleak, bleak...

And as people implored me to look at Wellesley/Wellington, as these balanced funds have often been touted as good and safe MFs for "Norwegian widows", I wanted to see for myself too. And when I happened to look at VUSTX, an MF most fit to represent long-term Treasuries, I was bothered that its performance appeared to be better than FIRECalc showed.

And my own spreadsheet result as posted above shows that a 50/50 Total Stock/Long Treas. did not do bad at all, compared to FIRECalc result.

I examined the spreadsheet downloaded from FIRECalc and saw the following. FIRECalc only applies the income or dividend of the bonds to its growth. FIRECalc does not consider the appreciation of the principal when the interest drops, and the bond yield follows it.

So, the bond portion, at least for the 30-yr treasury option, does not follow the market value as one sees with VUSTX. Because the bond is undervalued in FIRECalc, it does not provide enough "oomph" to help the lousy stock return. Rebalancing also does not help as much, because it does not have one outperforming half to sell high, in order to buy low with the other underperforming half.

How the above effect impacts the simulation results going way back prior to 2000, I do not know. But for the years 2000-2012, the lousy stock return should be cancelled out by the bond gain, and our hapless Y2K retiree would do a lot better if he had some more long bonds in his portfolio, and his long bond is

marked to market.

PS. I had very little long bond and still did well, but that's a story for another post.