you know, the subsidy can't be for everyone. I'm not on ACA yet (working thru cobra), but I wonder if they planned on everyone getting a subsidy. The ER may be a small enough demographic to not mess up the subsidy picture or it may be in the mix. As others have mentioned, I wonder if the Roth conversion may be a better long term strategy as it effect not only taxes, but medicare premiums as many are means tested.

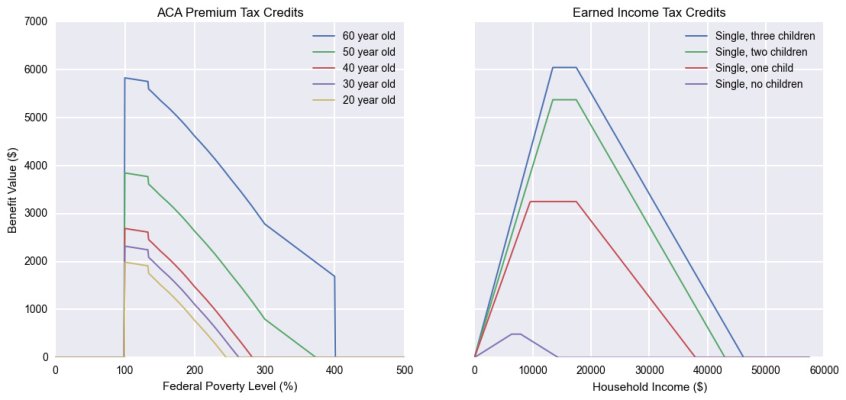

There was a post noting the subsidy was only $4 I think. How does this happen with the subsidy cliff? Is the cliff eliminated for the young?

There was a post noting the subsidy was only $4 I think. How does this happen with the subsidy cliff? Is the cliff eliminated for the young?