steelyman

Moderator Emeritus

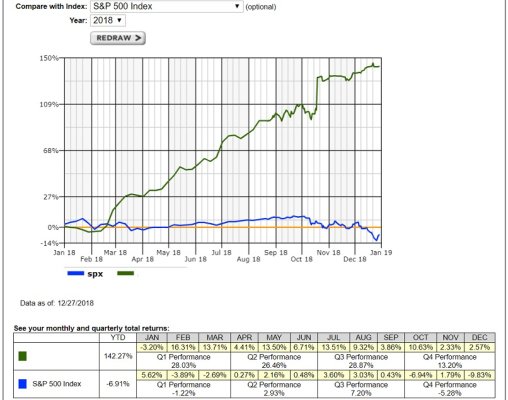

Yet another year-end distribution changed my number but not a whole lot. I’ll close out solidly south of -7% for the year. The real return will be lower but will wait for CPI to come out in January.

cya, 2018!

cya, 2018!