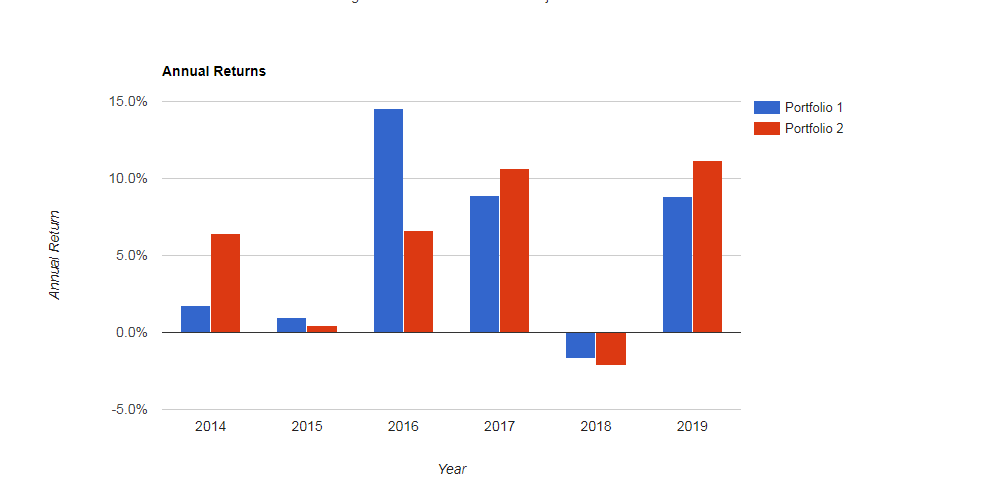

... As far as dropping further in the downturn, I never said that dividend stocks wouldn't drop more than non-dividend stocks. I said when they drop, you'll still get the dividend, and if you re-invest the dividends, you pick up stock on the cheap with that dividend. You'll also see that the dividend stocks recovered more quickly. ....

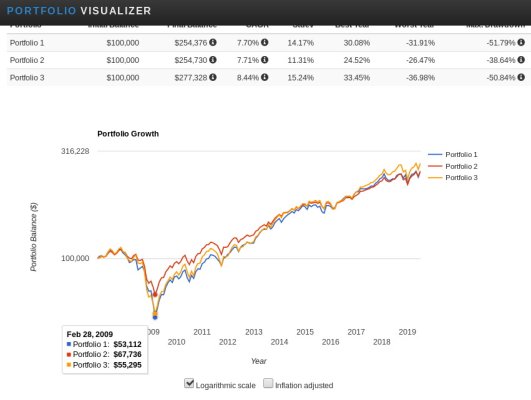

OK, you said it. But what good does that do? That chart, the attachment in my post #36, includes reinvestment of dividends. And VYM does not keep up with total market, and dropped far more than a risk-adjusted blend. And continued to lag during the recovery. I don't see the 'recovered more quickly' in that chart. Maybe, just maybe %-wise, but only because it dropped further? That's cold comfort.

... A bond/total market ETF blend is comparing apples and oranges in relation to the current discussion, so I don't have anything further to comment on that. ...

It is relevant to this discussion, but there were two reasons I included the blend:

#1) If I didn't, someone could rightly point out that VTI (Total Market) had higher volatility than than VYM (div stocks), so it isn't a fair comparison. So I added a bond element to match the performance of VYM, and to bring down the volatility. And the result is that VYM under-performs on a risk (volatility) adjusted basis too.

#2) Well, dividend stocks are looked at kind of like bonds - take the income stream and let the price take care of itself. So it really is relevant to compare to an AA containing bonds as I did in #1.

... Regardless of whether that particular mutual fund you compared to the market outperformed or underperformed doesn't prove much of anything. I don't know which individual stocks are in it and how they were picked. Did they just pick the highest dividend stocks without looking into the fundamentals? I don't know and I'm not willing to do the research.

When I said ETF, I misspoke. I meant lower cost mutual fund. And I don't have a ticker or know of one because I don't invest in mutual funds. I strictly do individual stocks and NASDAQ and S&P 500 ETFs.

Well that's good for you I guess. But as soon as we get into the

"I don't buy index funds/ETFs, I select stocks based on xyz", we have left the area of really being able to help anyone on this forum. Unless of course you have a method you can share that can be replicated by posters here, and can provide a full history so we can understand what we are getting into. I don't expect you can or would do that.

edit/add: Not sure that this helps, but if you subbed SPY for VTI, you'd see a very similar result they track closely. COuld probably throw some Q's in there too, but I have not looked at that in a while.

Not to be facetious, but I could answer that with a paraphrase of Will Roger's line,

' Just buy good stocks regardless of their dividend, when they go up, sell 'em. If they don't go up, don't buy 'em'.

But I can, and do, buy broad-based index funds/ETFs. And I can explain that to anyone in 10 minutes. I'm still looking for evidence, not hearsay, that I can reliably beat that. I haven't seen a sector that can, including a focus on div-payers.

-ERD50

(reference to the 'Beat Boho' thread for those not in on the joke).