VanWinkle

Thinks s/he gets paid by the post

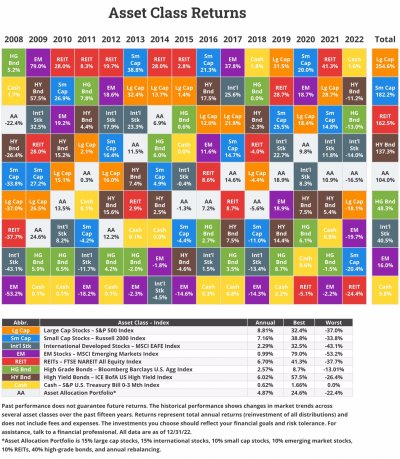

I want to start out that I'm not picking on you two but have just noticed a trend that is perplexing. For many posters, their disclosed 2022 returns are a lot better than the 2022 returns under Portfolio Visualizer for a portfolio with the same AA.

For example, a 50/40/10 AA consistent with MidPack's sig line returned -14.85% according to PV, but MidPack bettered it with -12.8% Similiarly, sengsational's reported return for 2022 was -14.3% but a 67/33 AA was -17.43% according to PV.

For the benchmark I used VTSAX (Total Stock Admiral) for equities, VBTLX (Total Bond Admiral) for bonds and CASHX for cash... PV's 2022 returns of -19.53% for VTSAX and -13.16% for VBTLX agreed with the 2022 return for those tickers on the Vanguard website and the CASHX return for 2022 was 1.82%, which seemed reasonable.

So the DQOTD is why are forum members reported returns so much better than the return for a similar AA on Portfolio Visualizer? Superior stock picking? Less interest rate sensitivity that VBTLX due to more IBonds and credit union CDs? Overall shorter duration for bonds and brokered CDs than VBTLX? Other reasons?

In the interest of full disclosure, my reported 2022 return of -4.17% was also significantly better than the -13% per PV for a similar AA... though while my AA drifted over the course of the year as I made some portfolio changes I think -13% is about right.

In my case I'm pretty sure that it is because I sold about 1/2 of my equities from the beginning of the year in January before the blood let too much. Also, 43% of my fixed income at the beginning of the year were preferred shares that I sold off in early February before things got too bloody. So I was cash heavy for a lot of the year.

Finally the fixed income that I didn't sell did a lot better than the -13.16% return for VBTLX in 2022 because it was mostly IBonds and credit union CDs that are not interest rate sensitive.

And yes, its a slow day so far.

Sounds like you were right once by reducing equities and selling off your preferred stocks before the carnage(tax consequences unknown). There will be another timing to get back in when the market turns and it is difficult to get both of these decisions right.

Good luck to you,

VW