ivinsfan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2007

- Messages

- 9,969

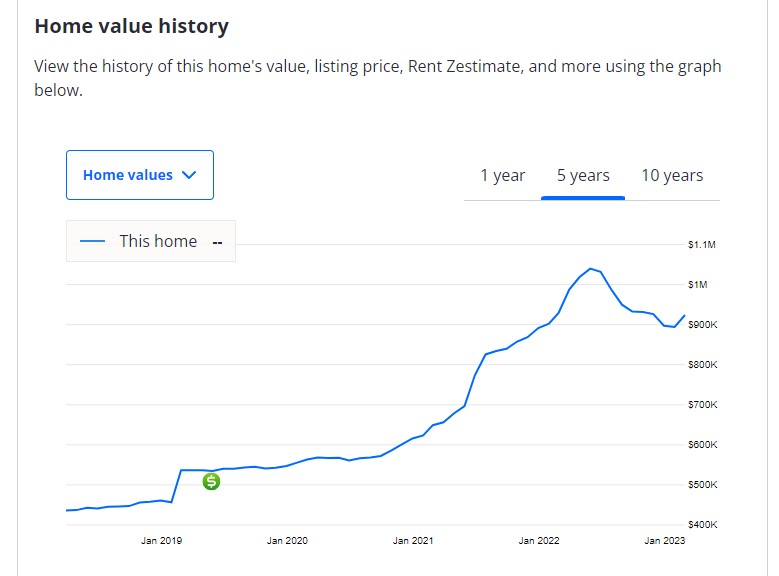

Interesting tidbit from recently spending a day looking at new homes. Agent mentioned that as interest rates have gone up that the builder has been reducing prices. It seems that they have a target cost per month for the customer and they have enough flexibility in the pricing to reduce prices as needed to keep that cost per month for the customer steady as interest rates increase.

We saw this happen after the big crash in Southern UT while poking around for a snowbird home...BUT also found lot sizes reduced, common areas made smaller and many "standard" items of lesser quality or less desirable. If you wanted apples to apples it definitely cost more money.

IMO successful builders are a lot like farmers, flexible and able to adjust on the fly. If they don't they won't stay in business.

My favorite part of the whole process was the several longstanding builders in the area let undeveloped or partly developed projects go back to the bank. After some time went by they bought each others failed projects for pennies on the dollars.