I’m not sure but my accounts are with Fidelity and you can buy Vanguard ETF’s on Fidelity’s platform. VTI is the total US stock market index ETF.

Is there an extra cost for purchasing Vanguard ETF's/Mutual Funds within Fidelity?

I’m not sure but my accounts are with Fidelity and you can buy Vanguard ETF’s on Fidelity’s platform. VTI is the total US stock market index ETF.

Is there an extra cost for purchasing Vanguard ETF's/Mutual Funds within Fidelity?

+1. Vanguard has us in a globally-diversified array of bond and stock index funds, which, last I tallied, exposes us to some 27,000 securities. Seems like one could approximate that with just two funds, the Vanguard World Stock and the World Bond fund, but who am I to argue with our Vanguard CFP?

I view both my pension and VA disability as the equivalent of a large portfolio of government bonds.

Same here, however I do not consider them as bonds. Because they are not bonds. Did you consider your military pay as bonds? Probably not. Same deal. BTW, thanks for your service.

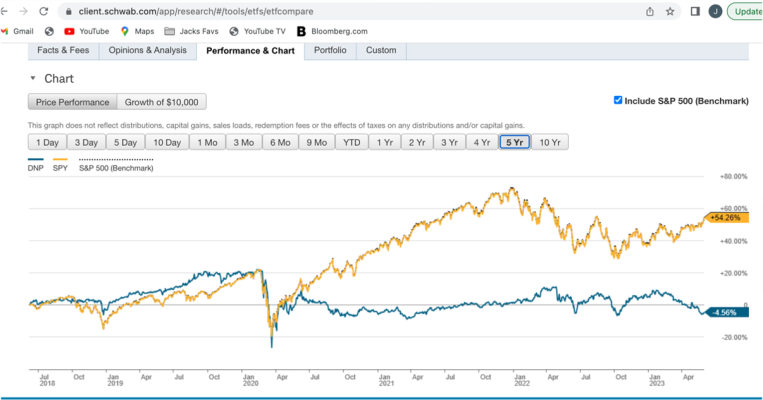

ummm. DNP has way underperformed SPY per the chart below. And its Net Expense Ratio is 1.9% vs 0.09% for SPY. Its distribution yield is 1.9% vs 1.5% for SPY. Sure its NAV is only $10 vs $427 for SPY, but its all apples to apples when you invest the same $ in each fund. DNP is primarily an Energy Fund: "Under normal conditions, more than 65% of the Fund's total assets will be invested in securities of public utility companies engaged in the production, transmission or distribution of electric energy, gas or telephone services" ...So I don't see any advantage of DNP over SPY, but maybe I'm missing something. View attachment 46177

Because the game can and often does change. A super rich German in 1925 who had also his wealth tied up in Weimar Republic bonds was wiped out in the next 20 years, but actually did ok with the German stock market, and even better if he held assets outside of Germany."I think it is all about diversification"

Agree, but if you have "won the game", why bother with the market at all?

For those of us who have "won the game"

I think it is all about diversification, as much as possible

A 100% fixed income with a 2% WR gives the illusion of safety. A decade of 10% inflation would require a 5% WR by the end of that period just to keep up with inflation.

Likewise 100% in SPY, has not only the obvious stock market risk, but US large cap have had a fabulous century for good reason, large US tech companies have literally changed the world. But AI, renewable energy, plus some tech I'm not smart enough to even identify, may change the world over the next 25 years. The companies that do that may be small startups today, or large foreign companies. Meaning an exposure to small caps and foreign stocks is a good idea.

100% Real Estate is also a bad idea, high interest rates hurt real estate, and perhaps manufactured homes and relaxed zone requirments will greatly increase the supply, who knows. Still at a minimum owning your own home, greatly reduces the risk of higher housing costs, blowing your budget.

100% commodities is obviously a bad idea, but a modest allocation to gold, oil or farmland or even crypto makes sense.

I've added some individually risky investments, angel investing, and hard money lending, plus a solar project, which generates income with minimal work, but to the extent they have a low correlation to the stock and bond market, I think they make sense.

Going all into the S&P at a single time of high valuations and extended US overperformance is risky.

I bet most here already have a large position in the S&P. For sure, starting in all cash would bring in a host of other considerations.

If you want to diversify, put equal money into US S&P, US Nasdaq, a commodity index, TLT, a foreign bond index, a foreign developed market index, and a foreign emerging market index and re-balance every year (or add funds to the underperformer).

+1 -- I do not have the stomach for a 20+ percent decline.

I bet most here already have a large position in the S&P. For sure, starting in all cash would bring in a host of other considerations.

3/7's foreign?

Many here did RE. Long retirement time horizon. Significant portion of assets shouldn't be needed for years. Doesn't concern me to have them ride through the storms. 20% crashes recover in an average of 3 years. Most of my money will sit for more than 20 years. I tend to agree with OP.

Has anyone made a "good" case for LESS diversity? Simplicity, yes. Diversity??

Of course, those of us with less risk tolerance and less knowledge are better off diversifying.Diversification is protection against ignorance," Buffett said. "It makes little sense if you know what you are doing." He also said: "A lot of great fortunes in the world have been made by owning a single wonderful business. If you understand the business, you don't need to own very many of them."

Everyone I know compares their performance to the S&P500.

That’s a good enough reason for me to stick with the S&P500 or in my case, Total US which tracks closely.

For 40 years I have been trying to beat the SP 500 and have failed.....I give up. My equity exposure from now on is SP 500. I'll bet I beat 97% of the rest. If you add in International I will beat 99.9%.

Backtest me 20 years and prove me wrong. Its' too simple to to understand.