You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best site to do a Monte Carlo Simulation

- Thread starter FREE866

- Start date

Are you looking for historical outcomes of some particular fund? That would have a date restriction of when that fund started. Portfolio Visualizer suggests alternate funds if there is a similar one available with a longer history. Monte Carlo doesn't use dates, it generates random sequences of returns.

Are you looking for historical outcomes of some particular fund? That would have a date restriction of when that fund started. Portfolio Visualizer suggests alternate funds if there is a similar one available with a longer history. Monte Carlo doesn't use dates, it generates random sequences of returns.

Right. I tried a different approach and it looks like the farthest it goes back is 1972. When I tested the portfolio with specific tickers the furthest was 1995. When I just did "asset classes" it went back to 1972

gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

Is there a MC simulator that allows for variability of inflation as well as asset class performance?

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

The Flexible Retirement Planner is the most robust monte carlo sim I have found. And it can be highly customized.

https://www.flexibleretirementplanner.com/wp/

https://www.flexibleretirementplanner.com/wp/

ncbill

Thinks s/he gets paid by the post

Just be aware MC simulations will give you larger tails that aren't supported in reality.

I.e. in actual historical data you never see the highest highs or lowest lows you'll see in a MC simulation.

I.e. in actual historical data you never see the highest highs or lowest lows you'll see in a MC simulation.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Which one would you suggest?

I've used Portfolio Visualizer in past , but when I run it the earliest date it goes back to is 1995

would like a longer one

thanks

Right. I tried a different approach and it looks like the farthest it goes back is 1972. When I tested the portfolio with specific tickers the furthest was 1995. When I just did "asset classes" it went back to 1972

From what you wrote you really seem to be looking for a historical simulator and not Monte Carlo.... Monte Carlo doesn't rely on historical information.

My guess would be that the reason that PV only went back to 1995 is because one of the tickers that you were including in you run didn't exist prior to 1995.

If you want a historical simulator, why not just use FIRECalc? Also, FIRECalc can do Monte Carlo simulations instead of its default historical simulations... it's the last option on the Your Portfolio tab.

From what you wrote you really seem to be looking for a historical simulator and not Monte Carlo.... Monte Carlo doesn't rely on historical information.

My guess would be that the reason that PV only went back to 1995 is because one of the tickers that you were including in you run didn't exist prior to 1995.

If you want a historical simulator, why not just use FIRECalc? Also, FIRECalc can do Monte Carlo simulations instead of its default historical simulations... it's the last option on the Your Portfolio tab.

Thx Pb....you are always so helpful as are others...correct about the ticker not being around in 1995

I will use that last option in the portfolio tab in Firecalc...thank you

You could check out Matlab from Mathworks.

The tool requires a few weeks of practice.

The company provides plenty of tutorials. Including a tutorial for Monte Carlo Simulation.

I think, the key question is still, what do you want to achieve?

We all know the saying Past Performance is no indicator of Future Performance.

The tool requires a few weeks of practice.

The company provides plenty of tutorials. Including a tutorial for Monte Carlo Simulation.

I think, the key question is still, what do you want to achieve?

We all know the saying Past Performance is no indicator of Future Performance.

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

From what you wrote you really seem to be looking for a historical simulator and not Monte Carlo.... Monte Carlo doesn't rely on historical information.

My guess would be that the reason that PV only went back to 1995 is because one of the tickers that you were including in you run didn't exist prior to 1995.

If you want a historical simulator, why not just use FIRECalc? Also, FIRECalc can do Monte Carlo simulations instead of its default historical simulations... it's the last option on the Your Portfolio tab.

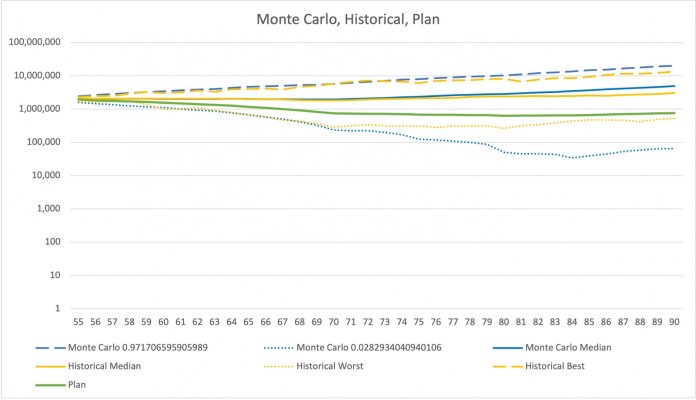

To be clear, every monte carlo sim I have used (including my own) uses historical returns to establish the average and standard deviations used to feed the model.

And as mentioned, monte carlo sims have tails. Both the worst case and the best case have tails, but the worst case tends to be a lot worse than historical models.

Attachments

Firecalc does everything the Flexible Retirement Planner does, judging from FRP's screenshot example.

Portfoliovisualizer "financial goals" model allows more types of inputs, and is therefore a more robust tool. It however is a historical return model.

Combining historical and Monte Carlo models is a robust retirement planning method.

It's interesting to see where the deterministic (historical) models land relative to a statistical (Monte Carlo) model. All of my deterministic modeling outputs land in the lower percentile outcomes of Monte Carlo outputs. This to me suggests conservatism in the deterministic modeling inputs. Or optimism in MC modeling.

Good comment above that the tails in MC analysis are candidates to be ignored/excluded.

If one excludes the 90%ile and 10%ile results of MC analysis, and compares with deterministic modelling, this is a useful and robust way to plan in my view. The 25%ile and 50%ile MC outputs are most usable in my view.

Portfoliovisualizer "financial goals" model allows more types of inputs, and is therefore a more robust tool. It however is a historical return model.

Combining historical and Monte Carlo models is a robust retirement planning method.

It's interesting to see where the deterministic (historical) models land relative to a statistical (Monte Carlo) model. All of my deterministic modeling outputs land in the lower percentile outcomes of Monte Carlo outputs. This to me suggests conservatism in the deterministic modeling inputs. Or optimism in MC modeling.

Good comment above that the tails in MC analysis are candidates to be ignored/excluded.

If one excludes the 90%ile and 10%ile results of MC analysis, and compares with deterministic modelling, this is a useful and robust way to plan in my view. The 25%ile and 50%ile MC outputs are most usable in my view.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

To be clear, every monte carlo sim I have used (including my own) uses historical returns to establish the average and standard deviations used to feed the model. ...

While it is common to base average return and variability on historical norms, you can input whatever assumptions you want for those...they don't necessarily need to be based on history.

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

While it is common to base average return and variability on historical norms, you can input whatever assumptions you want for those...they don't necessarily need to be based on history.

True. You have to pick something. I went through an exercise to try and make the monte carlo return distribution look more like historical. After screwing with it so much, all I accomplished was making my monte carlo model look like my historical model. Pretty useless.

Similar threads

- Replies

- 24

- Views

- 3K

- Replies

- 26

- Views

- 1K