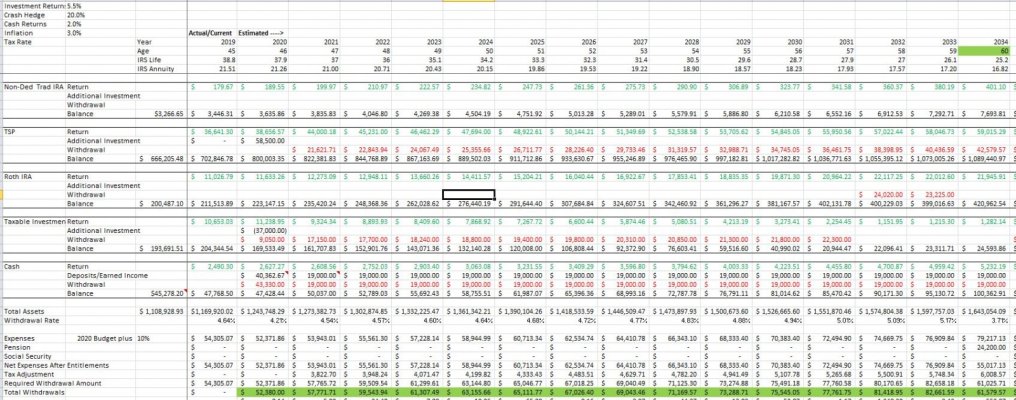

Hi guys… Planning to pull the plug on FT employment this summer - expect to earn some income in “retirement” but don’t want to depend on it. Below is a snapshot of my projected cash flow sheet (one version anyway as I’m constantly playing). I’m interested in your thoughts.

My general plan is to live off of taxable and any earned income as long as possible and will likely start SEPP on my TSP early enough (but later than this scenario) to allow the balance of the taxable to cover projected shortfall from the SEPP until I hit 60 and the pension starts/can break the SEPP. As to the Roth IRA, I intend to not touch it and treat it as insurance if I need to augment income from other investments (about 80K is contributions so I can get to that money easily).

I think I’m being pretty conservative in this scenario so a few things to point out:

Starting values are decreased by 20% (crash hedge) so essentially starting point is 80% of my current assets. Straight math using current asset values and no earned income puts my WDR at 3.4% at current values.

In this scenario I’m planning on netting $500/wk for 38 wks a year… just an estimate but I expect some income and think this is realistic doing things I enjoy (currently moonlighting beertending now and love it and hope to monetize other hobbies/interests when I have the free time). Calculated WD rate each year on the sheet includes this earned income so actual withdrawal from the portfolio will be lower.

Expenses are 10% higher than my projected/budgeted amount and assume no health care tax credit/paying full cost on an ACA plan but I should be able to manage my income to qualify for the credit. Other than health insurance (which will go down substantially if I qualify for the subsidy), my expenses should be lower and not higher than this estimate. My 2019 expenses were ~$40K.

I have an “off balance sheet” HSA currently funded enough to cover 3-4 years of max-out-of-pocket although I intend to let it ride (and intend to contribute to it each year as long as I have the cashflow).

Other explanations:

The negative taxable account investment in 2020 is a sale to cover paying off a loan against my TSP (realistically, will likely borrow from my HELOC (or possibly withdraw Roth IRA contributions) to avoid CG in 2020 and shift them to a year my income is under the 0% CG threshold or pay with earned income). TSP investment in 2020 is contributions plus the pay-off of the loan.

No tax adjustment in 2020 because my withholding should cover all taxes due. –I am assuming an effective rate of 12% on all income over the standard deduction but should be lower as I’ll try not to exceed the 0% CG threshold.

Assuming a 20% “crash” at day 0, average 5.5% market returns (obviously not accounting for volatility)/ and expenses 25% higher than current, I think this scenario should be conservative enough (probably too conservative). What are your thoughts?

The biggest wildcard to me, is playing around with when to start the SEPP but I really won’t know until I see how the market and my expenses play out (99% sure they’ll be lower than this). I will delay starting it as long as possible and hope to earn enough in “retirement” doing things I enjoy to cover all expenses. If I’m lucky and the market is friendly over the next decade, I should be able to derive most of my income needs solely from the SEPP as the RMD method will increase my payout over time.

Thanks for your thoughts and hope you enjoy the bit of financial voyeurism!

FLSUnFIRE

My general plan is to live off of taxable and any earned income as long as possible and will likely start SEPP on my TSP early enough (but later than this scenario) to allow the balance of the taxable to cover projected shortfall from the SEPP until I hit 60 and the pension starts/can break the SEPP. As to the Roth IRA, I intend to not touch it and treat it as insurance if I need to augment income from other investments (about 80K is contributions so I can get to that money easily).

I think I’m being pretty conservative in this scenario so a few things to point out:

Starting values are decreased by 20% (crash hedge) so essentially starting point is 80% of my current assets. Straight math using current asset values and no earned income puts my WDR at 3.4% at current values.

In this scenario I’m planning on netting $500/wk for 38 wks a year… just an estimate but I expect some income and think this is realistic doing things I enjoy (currently moonlighting beertending now and love it and hope to monetize other hobbies/interests when I have the free time). Calculated WD rate each year on the sheet includes this earned income so actual withdrawal from the portfolio will be lower.

Expenses are 10% higher than my projected/budgeted amount and assume no health care tax credit/paying full cost on an ACA plan but I should be able to manage my income to qualify for the credit. Other than health insurance (which will go down substantially if I qualify for the subsidy), my expenses should be lower and not higher than this estimate. My 2019 expenses were ~$40K.

I have an “off balance sheet” HSA currently funded enough to cover 3-4 years of max-out-of-pocket although I intend to let it ride (and intend to contribute to it each year as long as I have the cashflow).

Other explanations:

The negative taxable account investment in 2020 is a sale to cover paying off a loan against my TSP (realistically, will likely borrow from my HELOC (or possibly withdraw Roth IRA contributions) to avoid CG in 2020 and shift them to a year my income is under the 0% CG threshold or pay with earned income). TSP investment in 2020 is contributions plus the pay-off of the loan.

No tax adjustment in 2020 because my withholding should cover all taxes due. –I am assuming an effective rate of 12% on all income over the standard deduction but should be lower as I’ll try not to exceed the 0% CG threshold.

Assuming a 20% “crash” at day 0, average 5.5% market returns (obviously not accounting for volatility)/ and expenses 25% higher than current, I think this scenario should be conservative enough (probably too conservative). What are your thoughts?

The biggest wildcard to me, is playing around with when to start the SEPP but I really won’t know until I see how the market and my expenses play out (99% sure they’ll be lower than this). I will delay starting it as long as possible and hope to earn enough in “retirement” doing things I enjoy to cover all expenses. If I’m lucky and the market is friendly over the next decade, I should be able to derive most of my income needs solely from the SEPP as the RMD method will increase my payout over time.

Thanks for your thoughts and hope you enjoy the bit of financial voyeurism!

FLSUnFIRE