MercyMe

Recycles dryer sheets

- Joined

- May 7, 2022

- Messages

- 227

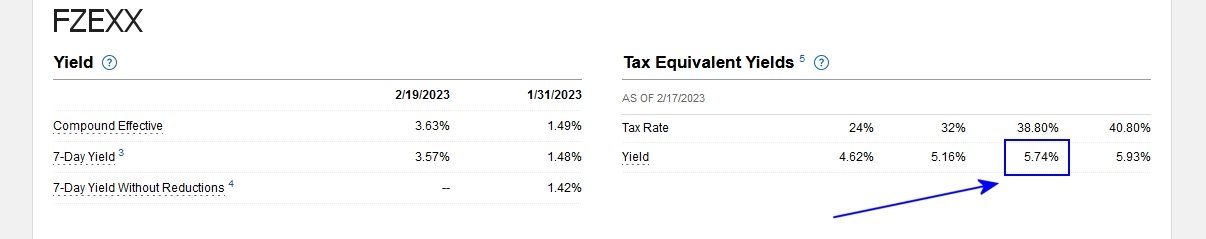

Perhaps foolishly, I waffled funds back and forth a couple times in 2022 between Fidelity's FZEXX and FZDXX chasing yield. I finally said enough of this and just left it in FZEXX, but now that fund's TEY is lagging FZDXX by more than 1% point.

Why does FZEXX go up and down so much?

Why does FZEXX go up and down so much?