Saw this published and thought it interesting.

Download the report here:https://www.ubs.com/global/en/family-office-uhnw/reports/global-wealth-report-2023/

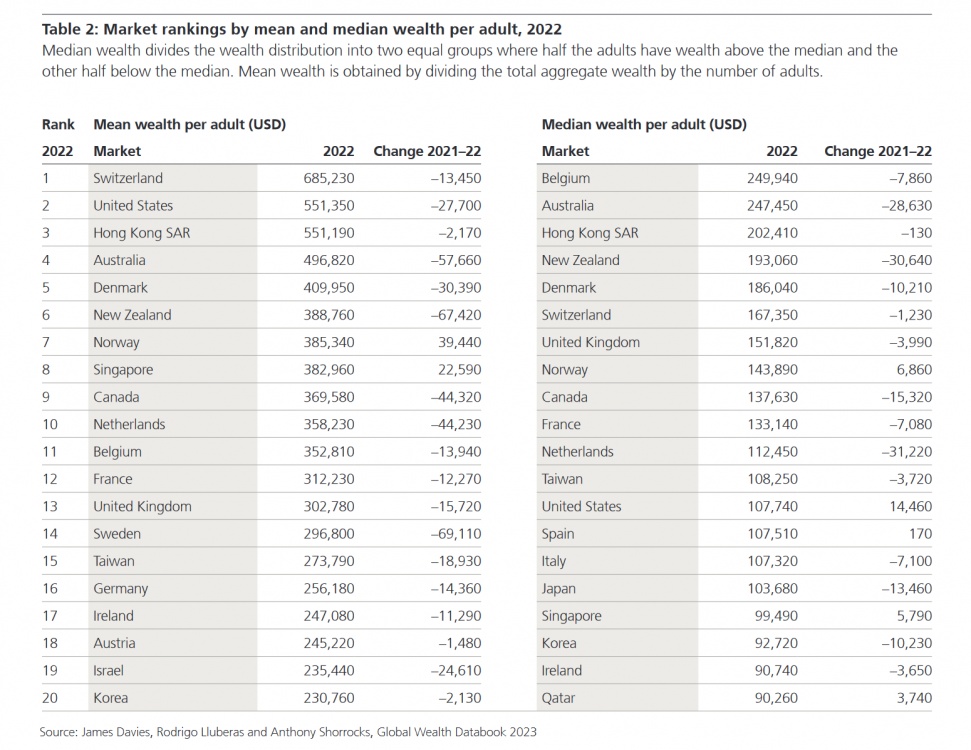

More than 3.5 million people lost their “dollar millionaire” status last year during the first fall in global wealth since the 2008 financial crisis.

The number of adults with assets of more than $1M fell from 62.9 million at the end of 2021 to 59.4 million at the end of 2022, according to the UBS annual wealth report, published on Tuesday. UBS said global wealth was depressed by high inflation and the collapse of many currencies against the dollar.

The number of millionaires in the US dropped by 1.8 million to 22.7 million, but there are still far more millionaires in the US than any other country. China had the second highest number with 6.2 million.

Download the report here:https://www.ubs.com/global/en/family-office-uhnw/reports/global-wealth-report-2023/