Curious how most 'model' for lack of a better word, their mortgage in firecalc or other retirement calculators, in relation to their minimum withdrawal, or any other not-indefinite expense for that matter (college for kids, healthcare).

Let's say you have 10 or 15 more years on the mortgage (obviously a moot point for those who paid it off), do you add in that payment as an additional expense for the first 10-15 years or whatever the case may be, and then have a base annual withdrawal rate that doesn't include the mortgage? Or do you just assume you'll always carry a mortgage of some kind and include the mortgage in your base withdrawal amount indefinitely? Or do you average it out between the two, figuring you'll spend more early, but less later so it will be a wash? (Do you not worry about a higher sequence of return risk then?)

Firecalc and others tend to focus on a more consistent desire for money, say 4% or whatever forever. But I'm realizing that if one carries a mortgage into early retirement the beginning of retirement will be much more expensive.

In the beginning you have:

For those who plan to or are using a constant inflation adjusted withdrawal amount, how do you account for this, or are all of you in the later years where these don't apply?

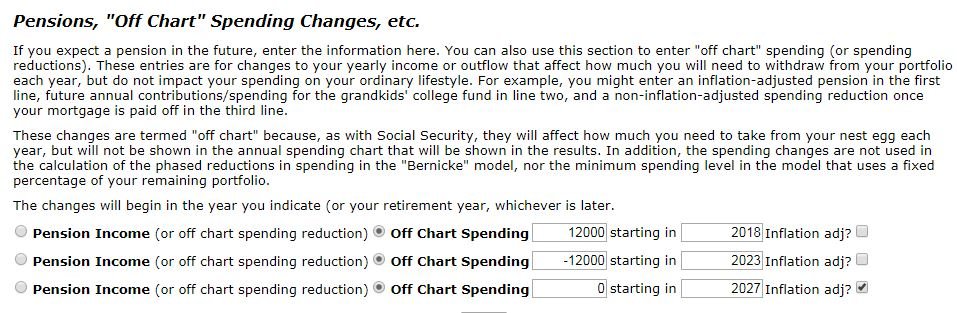

Maybe these more complicated simulations are more common and people just don't talk about it as much because it can't be summed up simply in a sentence or word like "4% inflation adjusted", "5% constant percentage", "VPW" etc.

Let's say you have 10 or 15 more years on the mortgage (obviously a moot point for those who paid it off), do you add in that payment as an additional expense for the first 10-15 years or whatever the case may be, and then have a base annual withdrawal rate that doesn't include the mortgage? Or do you just assume you'll always carry a mortgage of some kind and include the mortgage in your base withdrawal amount indefinitely? Or do you average it out between the two, figuring you'll spend more early, but less later so it will be a wash? (Do you not worry about a higher sequence of return risk then?)

Firecalc and others tend to focus on a more consistent desire for money, say 4% or whatever forever. But I'm realizing that if one carries a mortgage into early retirement the beginning of retirement will be much more expensive.

In the beginning you have:

- a mortgage payment

- individual market healthcare to pay for

- no social security income

- no mortgage payment

- significantly reduced healthcare costs (Medicare)

- social security income

For those who plan to or are using a constant inflation adjusted withdrawal amount, how do you account for this, or are all of you in the later years where these don't apply?

Maybe these more complicated simulations are more common and people just don't talk about it as much because it can't be summed up simply in a sentence or word like "4% inflation adjusted", "5% constant percentage", "VPW" etc.