I wanted to start a thread that is similar to the Important 2023 Trigger Income Limits linked here, but for Important 2023 Contribution limits.

The Social Security OSADI Contribution and Benefit base for 2023 is being raised from ($147,000 in 2022) to $160,200 in 2023.

See: https://www.ssa.gov/oact/cola/cbbdet.html This is essentially 2023 social security earnings limits cutoff. SO after $160,200 any additional earnings will not be counted towards the social security credit system. This is helpful for folks who are self employed and also define there own "reasonable" salaries for the year. It might not make sense to pay yourself more than $160,200 in 2023 since that is the cutoff for SS contribution benefits.

IRA Contribution Limits: $6,500 ($7,500 if you're age 50 or older)

401(k), 403(b), most 457 plans, and TSP Contribution Limits: $22,500 ($30,000 if you're age 50 or older)

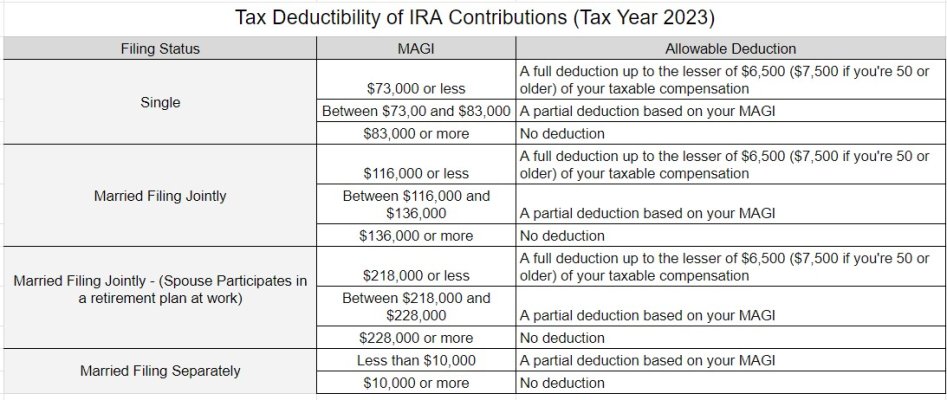

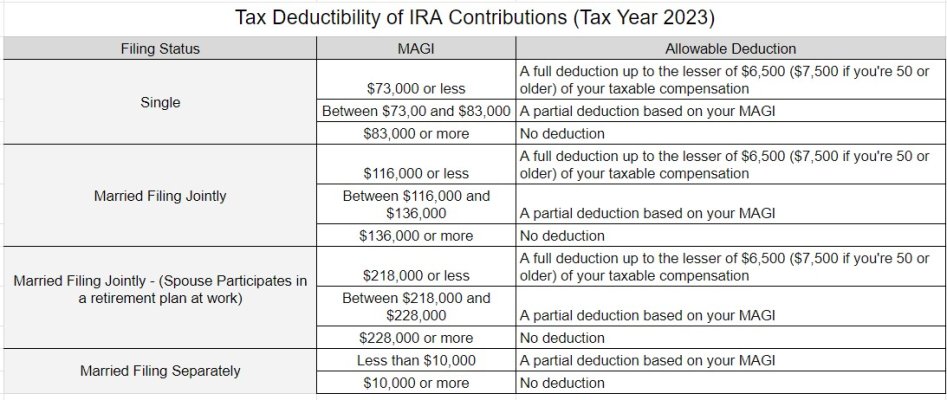

Tax Deductibility of IRA Contributions (Tax Year 2023)

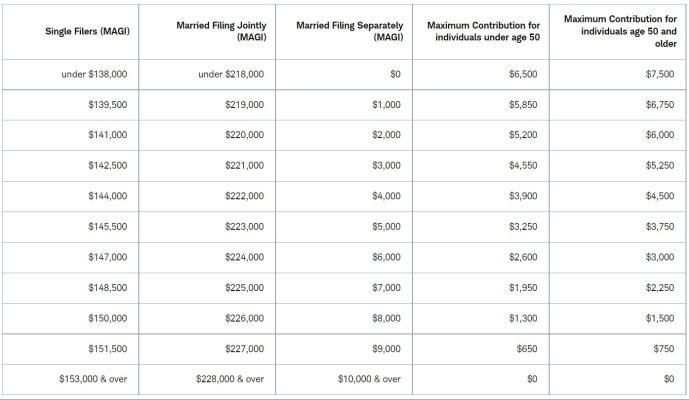

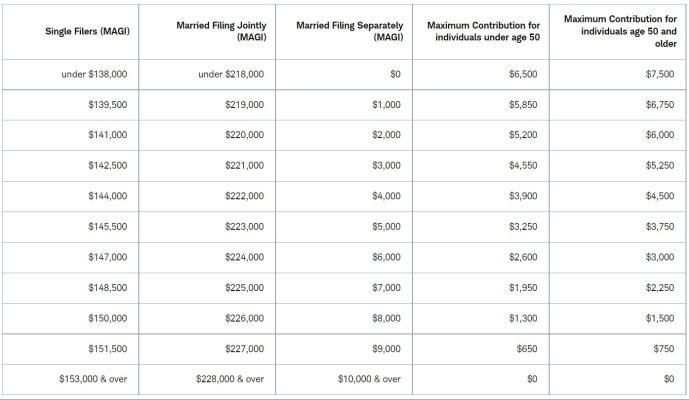

Roth IRA Contribution Limits (Tax Year 2023)

Some OTHER important solo entrepreneur contribution limits for 2023:

Solo 401k Employee Contribution Limit: $22,500 ($30,000 if you're age 50 or older)

Solo 401k Employer nonelective contributions: *Up to 25% of compensation not to exceed $66,000 ($73,500 if you're age 50 or older)

SEP Contribution Limits (including grandfathered SARSEPs: *Up to 25% of compensation not to exceed $66,000 ($69,500 if you're age 50 or older)

Custodial (Child) Roth IRA: $6,500 per child, per year. Contributions cannot exceed child's annual earned income.

*An Owner of a business can essentially claim a salary of up to $263,950.00 to retain the maximum contribution limit for Solo/SEP nonelective contributions of $66,000 - $22,500 for a total of $43,500 (employer) contributions.

As an example for me under age 50, I can put in $6,500 into Solo Roth 401k, $16,000 into my Solo 401k, and $43,500 as an Employer into the nonelective contributions. To sweeten then deal, I can also put in $6,500 into my Individual Roth IRA.

The Social Security OSADI Contribution and Benefit base for 2023 is being raised from ($147,000 in 2022) to $160,200 in 2023.

See: https://www.ssa.gov/oact/cola/cbbdet.html This is essentially 2023 social security earnings limits cutoff. SO after $160,200 any additional earnings will not be counted towards the social security credit system. This is helpful for folks who are self employed and also define there own "reasonable" salaries for the year. It might not make sense to pay yourself more than $160,200 in 2023 since that is the cutoff for SS contribution benefits.

IRA Contribution Limits: $6,500 ($7,500 if you're age 50 or older)

401(k), 403(b), most 457 plans, and TSP Contribution Limits: $22,500 ($30,000 if you're age 50 or older)

Tax Deductibility of IRA Contributions (Tax Year 2023)

Roth IRA Contribution Limits (Tax Year 2023)

Some OTHER important solo entrepreneur contribution limits for 2023:

Solo 401k Employee Contribution Limit: $22,500 ($30,000 if you're age 50 or older)

Solo 401k Employer nonelective contributions: *Up to 25% of compensation not to exceed $66,000 ($73,500 if you're age 50 or older)

SEP Contribution Limits (including grandfathered SARSEPs: *Up to 25% of compensation not to exceed $66,000 ($69,500 if you're age 50 or older)

Custodial (Child) Roth IRA: $6,500 per child, per year. Contributions cannot exceed child's annual earned income.

*An Owner of a business can essentially claim a salary of up to $263,950.00 to retain the maximum contribution limit for Solo/SEP nonelective contributions of $66,000 - $22,500 for a total of $43,500 (employer) contributions.

As an example for me under age 50, I can put in $6,500 into Solo Roth 401k, $16,000 into my Solo 401k, and $43,500 as an Employer into the nonelective contributions. To sweeten then deal, I can also put in $6,500 into my Individual Roth IRA.

Last edited: