TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

Preparing our income tax returns was relatively painless this year. Partly it was easy because each year our situation has gotten simpler.

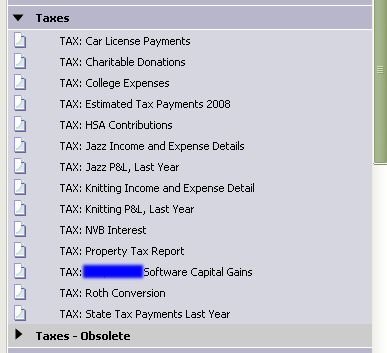

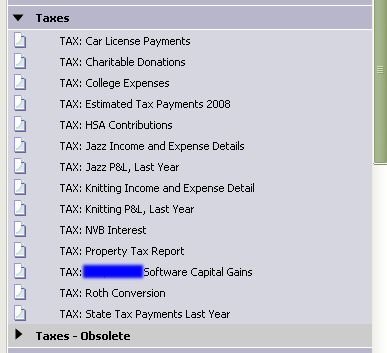

Here's one thing I do which has made things better. In Quicken I have a folder of reports just for taxes. So the first thing I do is to go through them and print them to PDF files.

Next, I scan in all the 1099s and other tax documents. All of these jpg files go into that same folder (for example, My Documents/Taxes/2008).

So at this point, everything I need is on the computer. Last year's reports and return are also available. I can sit in front of the fire and go through the TaxAct interview.

Got any tips?

Here's one thing I do which has made things better. In Quicken I have a folder of reports just for taxes. So the first thing I do is to go through them and print them to PDF files.

Next, I scan in all the 1099s and other tax documents. All of these jpg files go into that same folder (for example, My Documents/Taxes/2008).

So at this point, everything I need is on the computer. Last year's reports and return are also available. I can sit in front of the fire and go through the TaxAct interview.

Got any tips?