I have held FZROX since May 2022. It has returned 5.2% since then.

FZILX since May 2022. It has returned 2.8% since then.

FJRLX since summer 2018. It has returned 0.2%

Each fund represents roughly 13% of the total portfolio.

Over 5 years expenses is available in cash right now.

We are both retired and 2023 is the first year we have lived off the portfolio alone.

Annual expenses are around 6.3% of portfolio but when SS kicks in in 6 more years, it will cover half of that. Travel and dining expenses also are dialed back in 9 more years, and the retirement model shows the overall portfolio staying flat until ages 93/95 for DW and I.

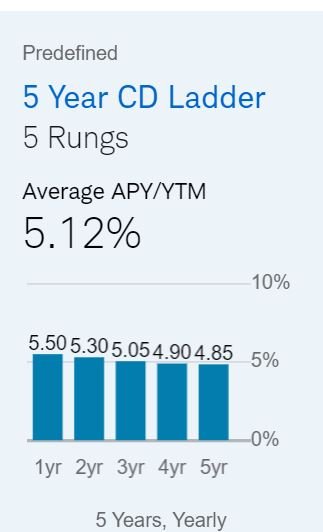

Morgan Stanley is offering a 1 yr CD for 5.65% right now.

I am thinking of selling off at least the ILX and ROX tomorrow and buying a 1 yr CD with the proceeds. Maybe selling off the RLX as well, but I am a bit more optimistic about the Bond markets (finally) heading north than I am the other two.

Seems like a no brainer to me (??). Overall portfolio AA is around 38/62 (I think, haven't calculated it in a while) and we are fairly conservative/low risk investors at this stage.

Thoughts?

FZILX since May 2022. It has returned 2.8% since then.

FJRLX since summer 2018. It has returned 0.2%

Each fund represents roughly 13% of the total portfolio.

Over 5 years expenses is available in cash right now.

We are both retired and 2023 is the first year we have lived off the portfolio alone.

Annual expenses are around 6.3% of portfolio but when SS kicks in in 6 more years, it will cover half of that. Travel and dining expenses also are dialed back in 9 more years, and the retirement model shows the overall portfolio staying flat until ages 93/95 for DW and I.

Morgan Stanley is offering a 1 yr CD for 5.65% right now.

I am thinking of selling off at least the ILX and ROX tomorrow and buying a 1 yr CD with the proceeds. Maybe selling off the RLX as well, but I am a bit more optimistic about the Bond markets (finally) heading north than I am the other two.

Seems like a no brainer to me (??). Overall portfolio AA is around 38/62 (I think, haven't calculated it in a while) and we are fairly conservative/low risk investors at this stage.

Thoughts?