ProfessionalOnFire

Confused about dryer sheets

My spouse and I retired early last year. Never invested in CD's before but looking to invest $250K in a 2-year CD and had a couple of questions:

1.) If CD's are FDIC insured, what is the Kroll Rating, and does it matter if they are rated a B or B-?

2.) With talk of the fed raising interest rates, will this directly affect CD rates and should I hold off a few more weeks?

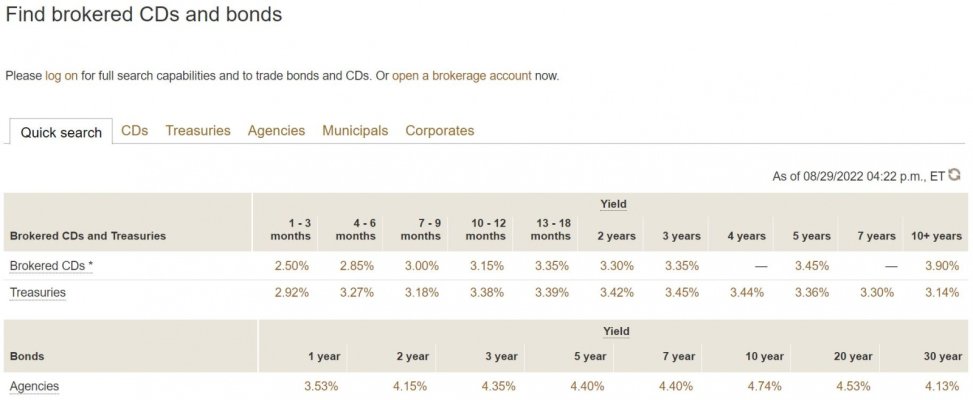

3.) where do you find the best rates for CD's?

1.) If CD's are FDIC insured, what is the Kroll Rating, and does it matter if they are rated a B or B-?

2.) With talk of the fed raising interest rates, will this directly affect CD rates and should I hold off a few more weeks?

3.) where do you find the best rates for CD's?