I'm planning to retire end of this year, if I don't get OMY syndrome and postpone it to next year.

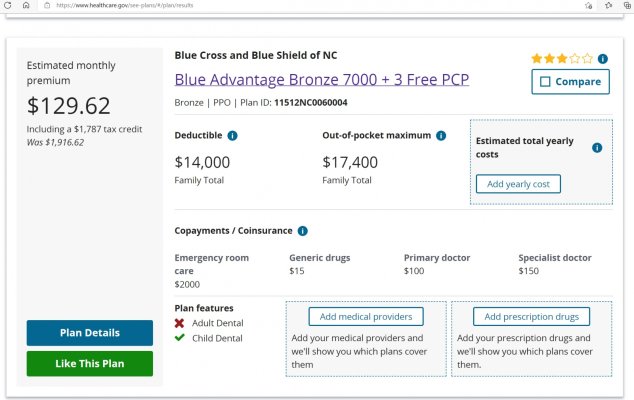

Since DW and I are pretty healthy, I was thinking of getting the Blue Cross Blue Shield PPO Bronze. Healthcare.gov quote is $145/month for Blue Cross PPO BRONZE for both myself and wife based on my projected withdrawal from IRA or 401K, so I reckon I will probably pay no more than $250-$300/month with an individual deductible limit of $7000 or $14000 combined limit for both DW and I.

The chances of us getting sick at the same time each year are low and would forgo paying $900+/month for the Silver Plan with $5000 deductible.

The Bronze PPO has a Nationwide coverage + 80% for out of network coverage + 3 Free Visits to a Primary care physician. Co-pay after the 3 free visits is $100 for primary care physician. Specialist is $160.

Do you guys think this is a good deal? If you have Bronze, or have BCBS, can you kindly give me any feedback what you think about these plan features, compared to yours. Thanks in advance.

Since DW and I are pretty healthy, I was thinking of getting the Blue Cross Blue Shield PPO Bronze. Healthcare.gov quote is $145/month for Blue Cross PPO BRONZE for both myself and wife based on my projected withdrawal from IRA or 401K, so I reckon I will probably pay no more than $250-$300/month with an individual deductible limit of $7000 or $14000 combined limit for both DW and I.

The chances of us getting sick at the same time each year are low and would forgo paying $900+/month for the Silver Plan with $5000 deductible.

The Bronze PPO has a Nationwide coverage + 80% for out of network coverage + 3 Free Visits to a Primary care physician. Co-pay after the 3 free visits is $100 for primary care physician. Specialist is $160.

Do you guys think this is a good deal? If you have Bronze, or have BCBS, can you kindly give me any feedback what you think about these plan features, compared to yours. Thanks in advance.