MBAVisionary

Recycles dryer sheets

I searched for similar threads with this topic but came up short. I also know I'm a little crazy with overthinking situations and long-winded... hopefully this isn't hard to follow.

Background: I know people say you should invest in Real Estate when you're financially able to... but this feels like the worst possible time to buy. Take one of the more affordable homes (not a condo) in my area. It's $325k, 4bedrooms, 2 bathrooms, slightly over 1700 sq. ft. Realistically I could save around $16k toward a down payment by the time my lease is up. It's very similar to a house I once co-owned 2013-2014. The big difference is then the house was ~$142k and our combined income was $170k not $325k value and $145k income. Same builder / same layout and sq footage. I see affordable places in the sticks but no one I knew lives out there.

Legally speaking I'm single and wouldn't be renting rooms out to anyone so all the burden would fall entirely on me. I also think I earn too much for downpayment assistance in my state, but nowhere near enough saved to avoid PMI. That would be $65k with today's prices and easily a 2+ year target given my current expenses. This is also on the lower end of the spectrum in terms of homes.

Current lifestyle: Rent a 1br low frills apartment ~$1240/mo, same place since December 2014. It's mostly quiet, clean, somewhat safe though a woman was fatally shot recently in a fluke road rage incident. Location isn't horrible but also not ideal. No kids, no pets. I don't own a ton of items. The largest expense I have is my vehicle, I like parking close to my front door without taking elevators or walking to a garage so some of these super large apartment communities are a big turnoff.

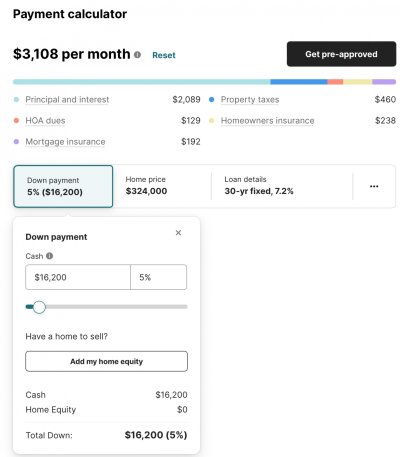

Napkin Math: Recurring monthly costs add up to $1019/mo or $12k/yr between HOA, mortgage insurance, property taxes, homeowners insurance. Then separately buyer's agent fee is ~$10k. The $16k down payment drops the amount financed to $307,800. On a 30 year fixed 7.2% interest on that is $22,162 per year to start with or $1,847/mo. $1019+$1847=$2,866/mo not including utilities, maintenance, or anything going to principal. I'm estimating all that other stuff to be $1000-1300/mo.

Questions / Thoughts:

1. Is there something I'm missing in this equation I should be thinking about?

2. Should I be concerned the tax assessment 2 years ago was over $100k less than the asking price which suggests to me that the home is overpriced? Even the 2023 assessment is $60k under the asking.

3. Do condos really suck as much as people say they do? Association fees, overly strict rules, drama, one-time assessments to cover major maintenance, lower appreciation rates vs stand-alone or townhomes come to mind.

4. Anyone 40+ who is still renting because it doesn't make sense for their lifestyle? Ask because in 10 years I could be a millionaire and still rent my home. That sounds weird but lots of people on here don't follow traditional rules of what is considered normal.

5. I looked at some homes for rent as opposed to buying. $2400/mo starting for anything decent. Still double what I pay now or more.

6. Several people I know are in the real estate industry. They seem biased and overly pushy on why I should buy now and not wait. Locking myself into a 7.2% interest rate at near all-time home values seems like a bad idea.

7. Saving is an option. I haven't really planned to buy a home and having 50% down or some other super high % would be a way to eliminate PMI, default risk, and being in a potentially high interest rate environment. That could mean staying in this apartment another 3 years or doing something else similar.

8. Buying a foreclosure or short-sale home is also a potential option down the line depending on how the economy or housing market goes. Closing is usually longer on those and sometimes the previous tenants destroy the property before leaning.

9. I hate owing money to banks, my car loan is a small % of my income but that is temporary. A 30 year loan seems like a huge commitment. I'll be 70 if I didn't pay it off early, that's too old in my opinion. Taxes would still be recurring every year even after it's paid off. More overhead..

10. If I lose my job for whatever reason there is a possibility I'd have to relocate. I mention this because there have been multiple rounds of layoffs the last 4 years. Statistically speaking I think my shelf life at my current company is probably 4 years or less. Some people stay much longer but it's rare.

11. If homes were around $220-$240k the math would be more palatable but we aren't there now, maybe not ever.

Background: I know people say you should invest in Real Estate when you're financially able to... but this feels like the worst possible time to buy. Take one of the more affordable homes (not a condo) in my area. It's $325k, 4bedrooms, 2 bathrooms, slightly over 1700 sq. ft. Realistically I could save around $16k toward a down payment by the time my lease is up. It's very similar to a house I once co-owned 2013-2014. The big difference is then the house was ~$142k and our combined income was $170k not $325k value and $145k income. Same builder / same layout and sq footage. I see affordable places in the sticks but no one I knew lives out there.

Legally speaking I'm single and wouldn't be renting rooms out to anyone so all the burden would fall entirely on me. I also think I earn too much for downpayment assistance in my state, but nowhere near enough saved to avoid PMI. That would be $65k with today's prices and easily a 2+ year target given my current expenses. This is also on the lower end of the spectrum in terms of homes.

Current lifestyle: Rent a 1br low frills apartment ~$1240/mo, same place since December 2014. It's mostly quiet, clean, somewhat safe though a woman was fatally shot recently in a fluke road rage incident. Location isn't horrible but also not ideal. No kids, no pets. I don't own a ton of items. The largest expense I have is my vehicle, I like parking close to my front door without taking elevators or walking to a garage so some of these super large apartment communities are a big turnoff.

Napkin Math: Recurring monthly costs add up to $1019/mo or $12k/yr between HOA, mortgage insurance, property taxes, homeowners insurance. Then separately buyer's agent fee is ~$10k. The $16k down payment drops the amount financed to $307,800. On a 30 year fixed 7.2% interest on that is $22,162 per year to start with or $1,847/mo. $1019+$1847=$2,866/mo not including utilities, maintenance, or anything going to principal. I'm estimating all that other stuff to be $1000-1300/mo.

Questions / Thoughts:

1. Is there something I'm missing in this equation I should be thinking about?

2. Should I be concerned the tax assessment 2 years ago was over $100k less than the asking price which suggests to me that the home is overpriced? Even the 2023 assessment is $60k under the asking.

3. Do condos really suck as much as people say they do? Association fees, overly strict rules, drama, one-time assessments to cover major maintenance, lower appreciation rates vs stand-alone or townhomes come to mind.

4. Anyone 40+ who is still renting because it doesn't make sense for their lifestyle? Ask because in 10 years I could be a millionaire and still rent my home. That sounds weird but lots of people on here don't follow traditional rules of what is considered normal.

5. I looked at some homes for rent as opposed to buying. $2400/mo starting for anything decent. Still double what I pay now or more.

6. Several people I know are in the real estate industry. They seem biased and overly pushy on why I should buy now and not wait. Locking myself into a 7.2% interest rate at near all-time home values seems like a bad idea.

7. Saving is an option. I haven't really planned to buy a home and having 50% down or some other super high % would be a way to eliminate PMI, default risk, and being in a potentially high interest rate environment. That could mean staying in this apartment another 3 years or doing something else similar.

8. Buying a foreclosure or short-sale home is also a potential option down the line depending on how the economy or housing market goes. Closing is usually longer on those and sometimes the previous tenants destroy the property before leaning.

9. I hate owing money to banks, my car loan is a small % of my income but that is temporary. A 30 year loan seems like a huge commitment. I'll be 70 if I didn't pay it off early, that's too old in my opinion. Taxes would still be recurring every year even after it's paid off. More overhead..

10. If I lose my job for whatever reason there is a possibility I'd have to relocate. I mention this because there have been multiple rounds of layoffs the last 4 years. Statistically speaking I think my shelf life at my current company is probably 4 years or less. Some people stay much longer but it's rare.

11. If homes were around $220-$240k the math would be more palatable but we aren't there now, maybe not ever.