I'm 5 years FIRE'd on Wed and today, DW told her boss on their weekly call of her planned retirement date in May. As such I have been running several models in Fidelity's calculator. About 25% of our portfolio is there now. Had pulled in other balances into it earlier in the year and updated them today.

DW and I picked a "comfort" number, a value that we want to see the calculator show in the portfolio at "end of plan", using "Below Average Returns". Then I went about making all sorts of changes to our budget expenses, one time BTD draws, and fattened our travel budget by 80%. See what it would take to trash this thing. I was amazed at how hard I could hammer this thing in the next 10 years and still keep it above our number at the end. Not surprising though, as we both have 30+ year careers in Megacorps and SS will be significant for us when we start drawing it.

Then I plugged numbers into FIREcalc, and like Fidelity, it showed that we could beat the crap out of the portfolio early on, and still hit 100% in FIREcalc. Encouraging.

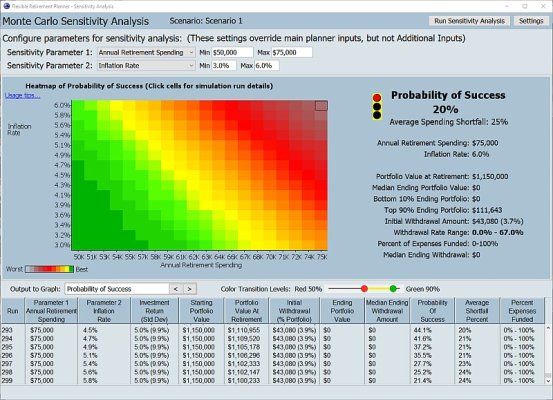

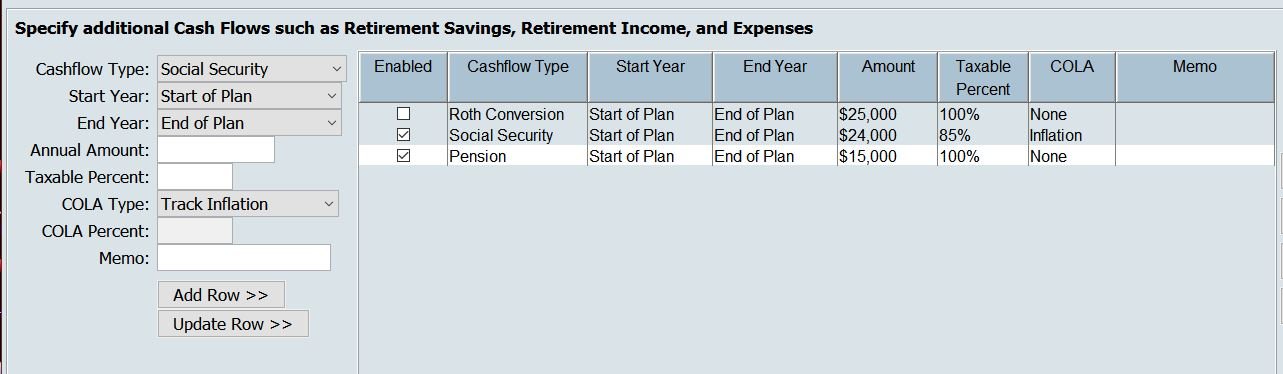

Anyway, both calculators have their limitations. Fidelity makes it hard to load "one time" or fixed period expenses AND have them show up in the analysis/report. FIREcalc only allows three addition/subtractions. Neither give me a clear view of Tax liability each year (I know, that can depend on a whole bunch of other stuff).

So I wanted to ask if there were some other good ones out there. I would love one that I could log into, plug values in ONCE (update as needed) and run scenarios. I wouldn't mind even paying a bit for it if it was really good. Feel free to point me to another thread if there is one. I did search the forums on RCs bit did get anything specific.

DW and I picked a "comfort" number, a value that we want to see the calculator show in the portfolio at "end of plan", using "Below Average Returns". Then I went about making all sorts of changes to our budget expenses, one time BTD draws, and fattened our travel budget by 80%. See what it would take to trash this thing. I was amazed at how hard I could hammer this thing in the next 10 years and still keep it above our number at the end. Not surprising though, as we both have 30+ year careers in Megacorps and SS will be significant for us when we start drawing it.

Then I plugged numbers into FIREcalc, and like Fidelity, it showed that we could beat the crap out of the portfolio early on, and still hit 100% in FIREcalc. Encouraging.

Anyway, both calculators have their limitations. Fidelity makes it hard to load "one time" or fixed period expenses AND have them show up in the analysis/report. FIREcalc only allows three addition/subtractions. Neither give me a clear view of Tax liability each year (I know, that can depend on a whole bunch of other stuff).

So I wanted to ask if there were some other good ones out there. I would love one that I could log into, plug values in ONCE (update as needed) and run scenarios. I wouldn't mind even paying a bit for it if it was really good. Feel free to point me to another thread if there is one. I did search the forums on RCs bit did get anything specific.