USGrant1962

Thinks s/he gets paid by the post

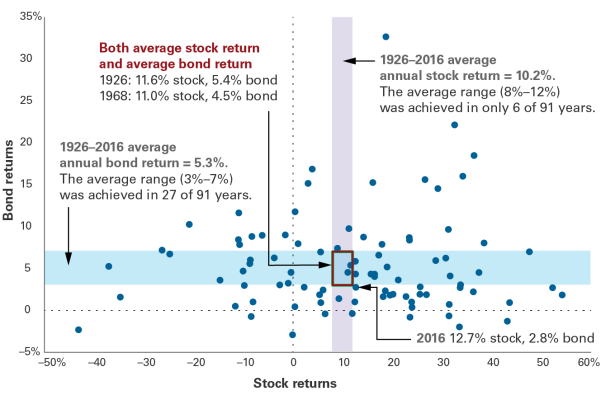

From the Vanguard blog, a really interesting graph of bond against stock returns per year.

https://vanguardretailblog.files.wo...nnyhoff_required-v-desired-returns_final1.png

Lots of interesting observations here. For example, bonds have never lost more than about 4% in a year. There were a couple of years when bonds gained over 20%, and as the headline pointed out - average returns are unusual.

Here's the full blog post: https://vanguardblog.com/2017/11/16/whats-your-benchmark-for-investment-success/

https://vanguardretailblog.files.wo...nnyhoff_required-v-desired-returns_final1.png

Lots of interesting observations here. For example, bonds have never lost more than about 4% in a year. There were a couple of years when bonds gained over 20%, and as the headline pointed out - average returns are unusual.

Here's the full blog post: https://vanguardblog.com/2017/11/16/whats-your-benchmark-for-investment-success/