jimbohoward69

Recycles dryer sheets

- Joined

- Feb 25, 2007

- Messages

- 70

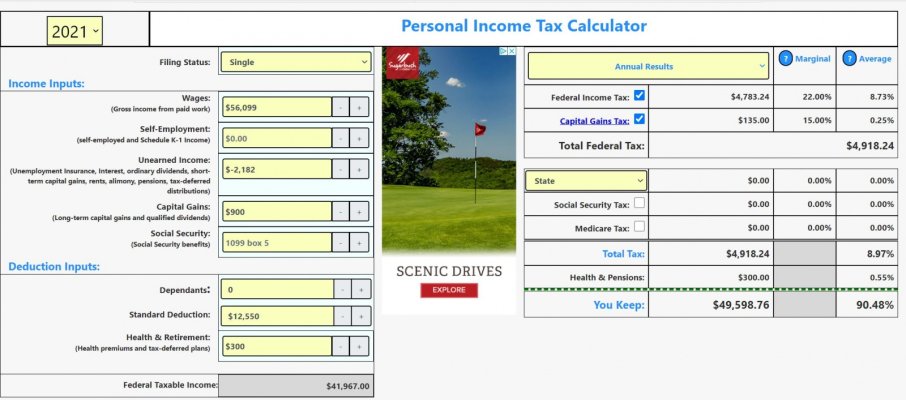

I was FIRE for over a year but decided to go back to work in April with the Veterans Health Administration...and LOVE IT! 2020 was a good year, tax wise that is, since I was able to harvest a bunch of LTCG w/my limited pension income. The tax math was pretty straight forward then...my pension filled up the 10% bucket and a smidgen of the 12%...leaving quite a bit of room up to the $40K threshold for the 0% LTCG/Qualified dividend rate.

This year will be different, obviously, since my ordinary income will be above the 0% LTCG rate. Here are some specifics (projected of course):

Ordinary Taxable Income (Salary & Pension) - $56,099

S/T Capital Gains - ($2,182) Covered call gone wrong

Qualified Dividends - $900

Charitable Deduction - ($300)

AGI - $54,517

Standard Deduction - ($12,550)

Taxable Income - $41,967

My question stems from where/how to account for S/T CG losses and the qualified dividends. Here's what I came up with:

Ordinary Income @ 10% - $9,950 - $995 taxes

Ordinary Income @ 12% - $30,575 - $3,669 taxes

Ordinary Income @ 22% - $542 - $119 taxes

Qualified Dividends @ 15% - $135 taxes

Total Taxes - $4,918

Just trying to figure out if I need to leave the QD's separate like I did or just figure it all in together. I like doing projections like this so I'm not left owing at the end of the year (can adjust withholding accordingly).

Any advice/feedback would be greatly appreciated...thanks!!

This year will be different, obviously, since my ordinary income will be above the 0% LTCG rate. Here are some specifics (projected of course):

Ordinary Taxable Income (Salary & Pension) - $56,099

S/T Capital Gains - ($2,182) Covered call gone wrong

Qualified Dividends - $900

Charitable Deduction - ($300)

AGI - $54,517

Standard Deduction - ($12,550)

Taxable Income - $41,967

My question stems from where/how to account for S/T CG losses and the qualified dividends. Here's what I came up with:

Ordinary Income @ 10% - $9,950 - $995 taxes

Ordinary Income @ 12% - $30,575 - $3,669 taxes

Ordinary Income @ 22% - $542 - $119 taxes

Qualified Dividends @ 15% - $135 taxes

Total Taxes - $4,918

Just trying to figure out if I need to leave the QD's separate like I did or just figure it all in together. I like doing projections like this so I'm not left owing at the end of the year (can adjust withholding accordingly).

Any advice/feedback would be greatly appreciated...thanks!!