Clover5

Recycles dryer sheets

- Joined

- May 4, 2013

- Messages

- 78

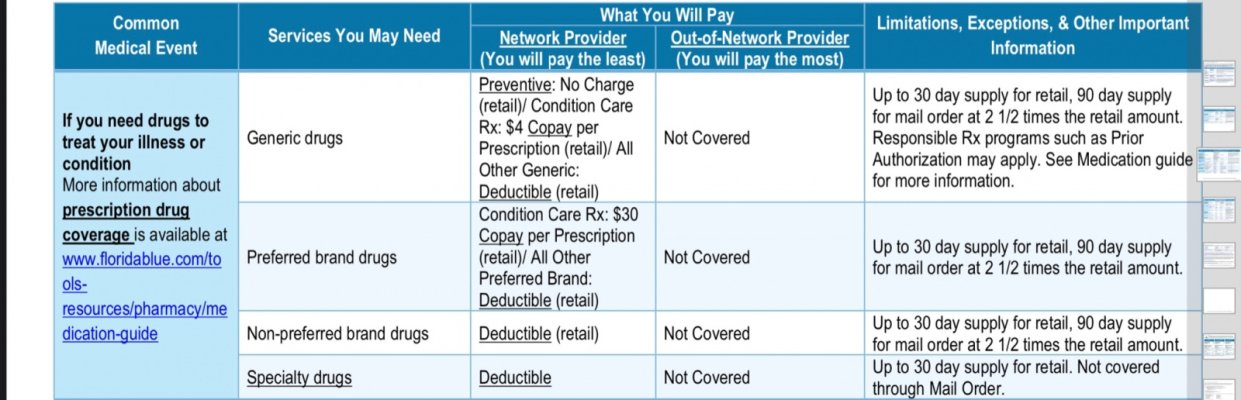

I have a chronic condition with pharmacy costs well past 100k annually. I had been thinking a Gold ACA plan was the way to go until I read a bogleheads posting about a HSA and started to look at the plans closer. In my mind HSA plans were for healthy people with occasional catastrophic medical costs.

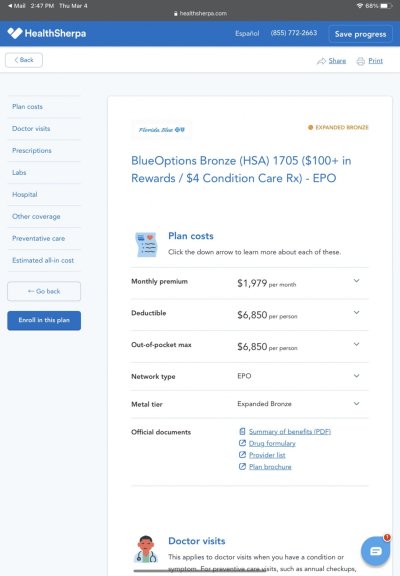

Comparing a $1900 monthly Extended Bronze HSA plan with a $6800 deductible, where I max out the deductible annually, and the plan pays all cost after deductible. Versus a Gold plan at $3200 a month with no deductible but with some cost sharing like 10%. It certainly seems like the HSA certainly saves me at least $6k a year with same level of care in a BCBSFL EPO.

Am I missing something?

Comparing a $1900 monthly Extended Bronze HSA plan with a $6800 deductible, where I max out the deductible annually, and the plan pays all cost after deductible. Versus a Gold plan at $3200 a month with no deductible but with some cost sharing like 10%. It certainly seems like the HSA certainly saves me at least $6k a year with same level of care in a BCBSFL EPO.

Am I missing something?