Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

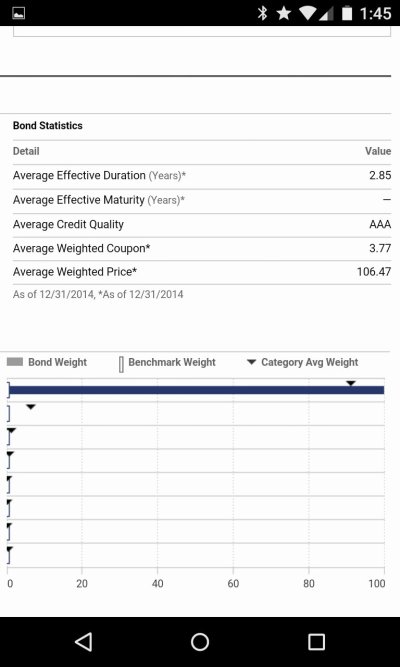

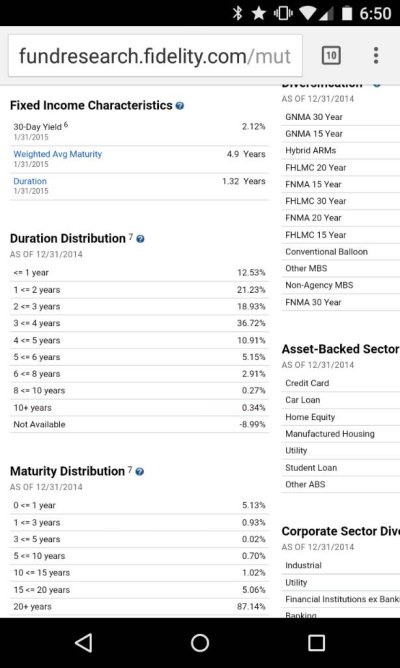

I am looking at a particular bond fund.

Its weighted average maturity is 4.9 years.

Its duration is 1.32 years.

If I understand duration correctly, this fund is not very sensitive to interest rate changes despite an average maturity that is almost 4 times longer. A 2% increase in interest rates would cause this fund to lose about 2.6% of its value. Correct?

Its weighted average maturity is 4.9 years.

Its duration is 1.32 years.

If I understand duration correctly, this fund is not very sensitive to interest rate changes despite an average maturity that is almost 4 times longer. A 2% increase in interest rates would cause this fund to lose about 2.6% of its value. Correct?

Last edited: