Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

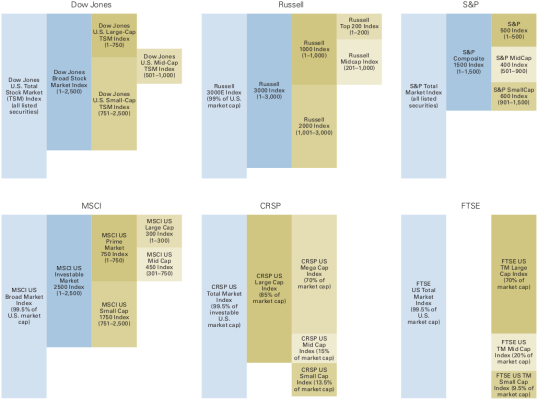

There are various types of indexes and several methods of weighting. I haven't studied each of them in detail, but I thought most include X number of stocks by some metric (often market cap). And the methodology re: what stocks are included, how rebalanced, etc. is typically public ("rules based"), so there really isn't anyone making arbitrary, biased or frequent choices.

The broad or composite indexes include thousands of stocks, or all stocks for a given category. Again what stocks, rebalancing, etc. are clearly defined, and would fit most definitions for "passive" funds.

It's probably accurate to say most if not all commonly known traded/held index funds are passive in comparison to actively managed funds. Are there funds that call themselves "index funds" that are actually actively managed? Wouldn't surprise me, but I don't know of any...

The broad or composite indexes include thousands of stocks, or all stocks for a given category. Again what stocks, rebalancing, etc. are clearly defined, and would fit most definitions for "passive" funds.

It's probably accurate to say most if not all commonly known traded/held index funds are passive in comparison to actively managed funds. Are there funds that call themselves "index funds" that are actually actively managed? Wouldn't surprise me, but I don't know of any...

Attachments

Last edited: