So, we may file an extension. We have paid plenty of estimated. No problem there.

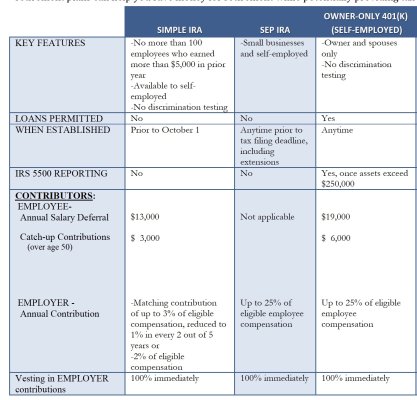

And I may put some earned income into Solo 401k as I did a little client work last year.

BUT - in October before filing the final tax return - if I want to change my mind and put less in the Solo 401k and get less refund - can I take the tax deferred money or part of it back out of the Solo 401k??

Just wondering.

P.S. I'm always confused by TurboTax's label because they don't call it Solo 401k...

And I may put some earned income into Solo 401k as I did a little client work last year.

BUT - in October before filing the final tax return - if I want to change my mind and put less in the Solo 401k and get less refund - can I take the tax deferred money or part of it back out of the Solo 401k??

Just wondering.

P.S. I'm always confused by TurboTax's label because they don't call it Solo 401k...