As the title states, I am 26 years old. I started in the workforce at 18. I have been making over $160,000 since I was 21 and after 3 promotions I am now at a $350,000 position that I've had for over a year. I like to think I am a very responsible person however I sometimes can't control my spending. I am frugal with some things but others I have no self control. I had a home built at 21 years old which is almost paid for but I think that for as much as I make I am not putting away enough.

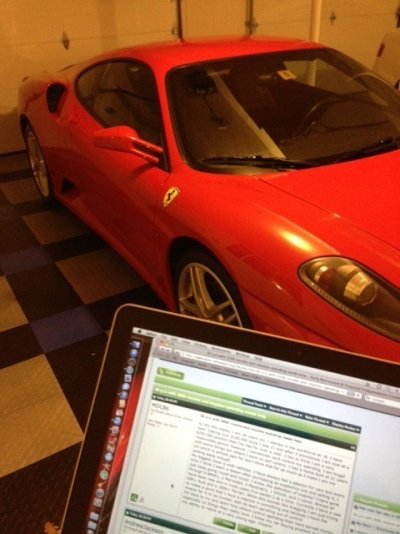

My biggest issue is with vehicles. I have always had a passion for cars and every time I think I learn a lesson after purchasing an expensive one and selling it, I just keep going round and round. I know, the definition of insanity! I have gone through 9 BMW's, 2 Mercedes, 2 Maserati's, 1 Infiniti, and 1 Lexus. Almost all have been new and in most cases I've owned 2 at a time. Currently I have a new 60K+ Audi and a 160K+ Ferrari. While this sounds like bragging I am just trying to make a point that I have a interest in something and because I have the means for it to be funded, well its been spiraling out of control.

I'm here to try and learn how others control spending their hard earned money especially on things they really love. I know my car buying problem is hindering my ability to retire at a very young age. Cheers!

My biggest issue is with vehicles. I have always had a passion for cars and every time I think I learn a lesson after purchasing an expensive one and selling it, I just keep going round and round. I know, the definition of insanity! I have gone through 9 BMW's, 2 Mercedes, 2 Maserati's, 1 Infiniti, and 1 Lexus. Almost all have been new and in most cases I've owned 2 at a time. Currently I have a new 60K+ Audi and a 160K+ Ferrari. While this sounds like bragging I am just trying to make a point that I have a interest in something and because I have the means for it to be funded, well its been spiraling out of control.

I'm here to try and learn how others control spending their hard earned money especially on things they really love. I know my car buying problem is hindering my ability to retire at a very young age. Cheers!

Last edited: