Q3 - 2017 update

Total of Savings+investments: $575k (+55k YTD)

- Cash position (included in the above total): $257k I know, I know

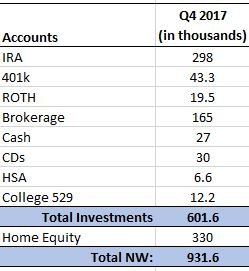

Looks like I'll close out the year with $580k-585k and then cross the $600k milestone in Q1 2018.

Total of Savings+investments: $575k (+55k YTD)

- Cash position (included in the above total): $257k I know, I know

Looks like I'll close out the year with $580k-585k and then cross the $600k milestone in Q1 2018.

Even towards the end of Nov I didn't think it was going to happen!

Even towards the end of Nov I didn't think it was going to happen!