Edit: There have been several other posts on this thread in just the past hour, while I was composing my reply. I think that some of what I said is not applicable, e.g. it seems like the OP has just clarified that the 155k already includes taxes, which is not what I thought he meant. Also I see there have been other comments about how Firecalc works (which I have just now skimmed but haven't read in detail). I'm just going to leave my reply as it stands, and if the OP gets something useful from it then fine but if this has already been covered in the past few replies then feel free to ignore my comments.

You don't say anything about how much of your your investable assets are pre-tax retirement, Roth, or non-retirement. Make sure you have enough non-retirement or Roth assets to last until age 59.5, otherwise there will be a 10% withdrawal penalty, which Firecalc won't be including in the calculations.

You need to include taxes in your data for Firecalc. E.g., if you will be using up non-retirement money until age 60 and then drawing from pre-tax retirement sources thereafter, at a 25% income tax rate you will need to pull 207k to have 155k of spending money. One way to do this in Firecalc is to add the extra amount as "Off Chart spending" starting the year you are 60 (or whatever age you will start pulling from pre-tax).

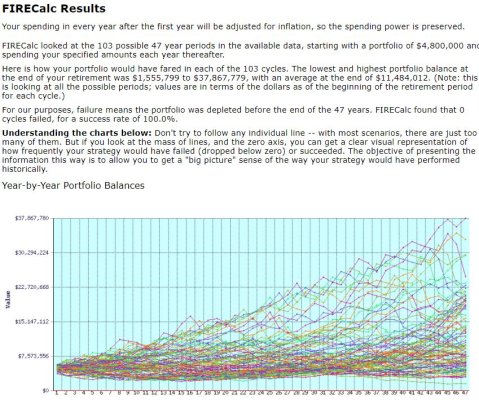

When the assets drop by 40-50%, it is due to early years in the Firecalc simulation being very bad years (like the Great Depression). But historically, the several bad years have always been followed by enough good years to raise the assets back up per Firecalc.

As useful as Firecalc is, it can only tell us so much since real life is not an historical simulation. On the one hand, it's extremely unlikely that a scenario as bad as the Great Depression will happen right after you retire. On the other hand - if that did happen, and you watched your assets drop by 40% over the first 8-10 yrs of your retirement due to a long-lasting bear stock market, you wouldn't know for sure that this will be followed up by several good years in the future. I imagine there would be a lot of hand-wringing by a lot of retirees to try to preserve their assets by going back to work, cutting expenses, etc.!