4merKPer

Dryer sheet wannabe

- Joined

- May 12, 2010

- Messages

- 24

Hi everyone!

Long time lurker and fan of this site. After 28 years with Mega-HealthCorp, I was outsourced with several hundred other IT workers last year. Until recently, have been on UI, but have decided not to "re-up," as employment opportunities are dim and frankly, the thought of returning to the zoo is fast becoming unbearable. Fortunately, DW and I have lived below our means and I've been working on my retirement spreadsheet for years.

My plan:

Results:

Questions:

Any feedback appreciated. I've already learned a lot here and it's nice not feeling like I'm going through this alone.

Long time lurker and fan of this site. After 28 years with Mega-HealthCorp, I was outsourced with several hundred other IT workers last year. Until recently, have been on UI, but have decided not to "re-up," as employment opportunities are dim and frankly, the thought of returning to the zoo is fast becoming unbearable. Fortunately, DW and I have lived below our means and I've been working on my retirement spreadsheet for years.

My plan:

- Current living expenses: use liquid accounts (GNMA, tax-exempt muni-bond fund, CD's, MM, etc.), which total about $700K until I'm 60 (yes, I have been very conservative - the dot-com bust of 2000 and subsequent market drops are still burned into my brain)

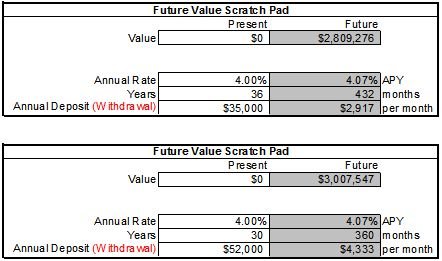

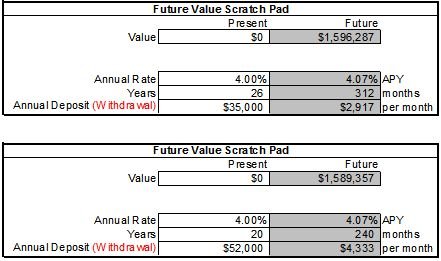

- Postpone my pension (currently would pay out $35K/year) until I'm 60, when it would pay out about $52K/year (non-COLA).

- At 60+, access my retirement IRA accounts as needed. Currently $850K: 50/50 stocks/bonds (Wellington and Total Bond Market Index, as well as a little bit in Fidelity Growth&Income).

- SS kicks in at 66 and four months for me at nearly $28K/year; DW kicks in seven year later at $8K/year.

- Starting bare minimum living expenses - $40K/year (house is paid off, no debt, healthcare provided by Mega-HealthCorp)

- Inflation rate - 3% (living expenses increase by this percent every year)

- Return on liquid accounts - 1.5%

- Return on IRA accounts - 3%

- DW works PT, but everything she makes she spends, so her numbers are a wash

Results:

- With my spreadsheet, I can vary any of the above assumptions. Using the $40K bare living expenses assumption, the portfolio increases, so success!

- Using a $60K/year expense assumption, it's basically a steady state. So, it would seem I have a $20K buffer of disposable income each year (subject to actual market returns). So we should be able to spend to actually enjoy life and not just pay the bills!

Questions:

- Sanity check on my assumptions and spreadsheet results. Are my assumptions reasonable and do my projected results sound right?

- Recommendations (given my bias towards security versus maximizing returns). I know I currently have a lot in liquid accounts, but am afraid of riskier investments, since I need to live off of these accounts until I access my pension. A little worried about what will happen with bonds when inflation finally kicks in.

- SS projection-I calculated that from the SS website, accounting for stopping work at age 53, since the annual SS report assumes working until normal retirement age. The SS website also provides an inflation-adjusted projection, which boosts my $28K/year figure to $41K/year, which matches a 3% inflation rate. Does anyone have experience with this? Obviously, the $41K figure makes things even better, but am interpreting this correctly?

Any feedback appreciated. I've already learned a lot here and it's nice not feeling like I'm going through this alone.