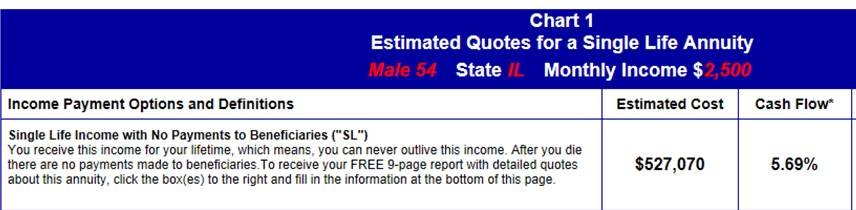

I am 54 and have been looking for work for over a year and have decided that it may be best to hang it up. I have $620,000 in assets allocated as 56% stock, 30% bond and 14% cash. I am single, no kids, no debt, co own a 2 family home with my sister which we may sell in a few years. (I live on the 2nd floor, she on the first.) I am concerned about that when we sell, my housing costs will go up as we will go our separate ways. My present living expenses including health insurance is about $30,000/yr. I was wondering if I have a good chance of ER and was thinking of purchasing an annuity to generate monthly income, but not sure which kind would be best, what initial amount would be reasonable or if this is even a good option. Or maybe there are better options.

I would appreciate any advice.

Thank you,

Joe

I would appreciate any advice.

Thank you,

Joe