Moneybags

Confused about dryer sheets

Hello everyone. A few years ago I decided to FIRE and feeling that I am alone and looking for support group on this subject. When I bring up to family and people around me that I do not want to work anymore and want to retire early I get laughed at, like is just expected that you work until you are 67. So I am here hopefully to find like minded people similar to me so I do not feel so alone in this FIRE journey share ideas and hopefully learn something new.

I am 43 years old and work as an engineer and over the past few years I have been getting burned out on the job. I am tired of working 45+ hours a week and feeling burnt out. I use to work 50+ and over the years have been cutting back. I do like engineering but after working for so many years it all starts to become repetitive, and the job is not as fulfilling as it used to be. I do not like giving up so much of my life to a job I do not enjoy anymore and do not feel appreciated at work. I feel I am not benefiting or improving the world and which I can find work that has a better purpose. I would like to enjoy my life and do what I want to do, maybe work part time, travel in an RV, take on different jobs that interest me more at the time.

So I am 43 years old and married and wife that also works also works and no kids (DINK). She also does not enjoy your job and she would like to retire sooner as well. I am slowly working with my wife and having her invest more in 401k and open up a taxable account. Currently I am targeting to retire in 2035, at age 55, and save about $2.5M in a brokerage account so I can retire early and hopefully make enough income from my investments that I do not need to worry about money until I die. If I can make a similar amount from my investments every year as my work income I will feel good about retiring early. I also planning on a backup plan to save in retirements accounts in brokerage account does not work out or I change my mind. I feel that I am pretty frugal, we stay at home most of the time, very rarely eat out, and I feel I have cut my costs as much as I can but open to new ideas. I have started to sign up for credit cards to put our normal spending of utilities, food and save some money with cashback.

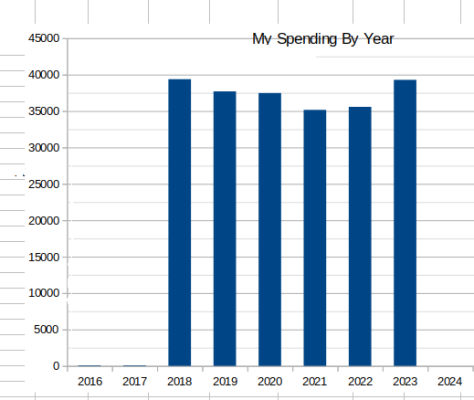

In 2023 this is currently my stats and does not include my wife.

Income:

Work Income: $145K, before taxes and retirement funding.

Retirement:

401K, Traditional: $130K, last couple of years started to max out and plan to in the future

401K, Roth: $123K

IRA, Roth: $175K

HSA: $15K

ESOP (Employee Stock Ownership Plan): $635k

Cash:

Savings: $138K

T-Bills: $241K

Muni Bonds: $85K

Peer to Peer loans: $6k

Taxable Brokerage: $247K (ETF- 60% S&P 500, 35% Nasdaq, 5% semi-conductor)

Debt:

School Loans: $3,500, Interest 2.625%, I have money reserved aside and can fully pay it off but currently have it is savings and T-bills that is paying me higher interest, so will make money hold the loan.

Mortgage: which will be paid off in a few month. Home value: 360k but I do not have it factored into my amounts above since we are not planning on selling house and it does not generate income.

Current expenses: 19K which includes mortgage payments + extra to principal. The house will full be paid off in a few months.

Goals:

Invest $36K/year: or more in taxable account

Car Savings: $500 month, currently have 33K saved. My car is 24 years old. My goal is about 40-45K saved which is worst case if I buy new, but planning on buying a newer used car.

RV Savings: $100 month

I am 43 years old and work as an engineer and over the past few years I have been getting burned out on the job. I am tired of working 45+ hours a week and feeling burnt out. I use to work 50+ and over the years have been cutting back. I do like engineering but after working for so many years it all starts to become repetitive, and the job is not as fulfilling as it used to be. I do not like giving up so much of my life to a job I do not enjoy anymore and do not feel appreciated at work. I feel I am not benefiting or improving the world and which I can find work that has a better purpose. I would like to enjoy my life and do what I want to do, maybe work part time, travel in an RV, take on different jobs that interest me more at the time.

So I am 43 years old and married and wife that also works also works and no kids (DINK). She also does not enjoy your job and she would like to retire sooner as well. I am slowly working with my wife and having her invest more in 401k and open up a taxable account. Currently I am targeting to retire in 2035, at age 55, and save about $2.5M in a brokerage account so I can retire early and hopefully make enough income from my investments that I do not need to worry about money until I die. If I can make a similar amount from my investments every year as my work income I will feel good about retiring early. I also planning on a backup plan to save in retirements accounts in brokerage account does not work out or I change my mind. I feel that I am pretty frugal, we stay at home most of the time, very rarely eat out, and I feel I have cut my costs as much as I can but open to new ideas. I have started to sign up for credit cards to put our normal spending of utilities, food and save some money with cashback.

In 2023 this is currently my stats and does not include my wife.

Income:

Work Income: $145K, before taxes and retirement funding.

Retirement:

401K, Traditional: $130K, last couple of years started to max out and plan to in the future

401K, Roth: $123K

IRA, Roth: $175K

HSA: $15K

ESOP (Employee Stock Ownership Plan): $635k

Cash:

Savings: $138K

T-Bills: $241K

Muni Bonds: $85K

Peer to Peer loans: $6k

Taxable Brokerage: $247K (ETF- 60% S&P 500, 35% Nasdaq, 5% semi-conductor)

Debt:

School Loans: $3,500, Interest 2.625%, I have money reserved aside and can fully pay it off but currently have it is savings and T-bills that is paying me higher interest, so will make money hold the loan.

Mortgage: which will be paid off in a few month. Home value: 360k but I do not have it factored into my amounts above since we are not planning on selling house and it does not generate income.

Current expenses: 19K which includes mortgage payments + extra to principal. The house will full be paid off in a few months.

Goals:

Invest $36K/year: or more in taxable account

Car Savings: $500 month, currently have 33K saved. My car is 24 years old. My goal is about 40-45K saved which is worst case if I buy new, but planning on buying a newer used car.

RV Savings: $100 month

Last edited: