Hello everyone, I'm very excited to be apart of this community.

I am looking to get some advice on some debts and if I am on track or not. I can mess around with financial calculators all day but, I'm looking for some advice and I am here to learn. Just finished reading "Your money or your life" and I'm going to be starting some financial habits outlined in the book.

I am 33, and looking to retire around 65 in 2053. I'm not in a rush to retire but, if I can make it happen sooner that would be great! I am looking to go back to school in the fall to pursue my Masters. This will add on about $35,000 in debt.

I earn $44,500K a year (after taxes) 55K before and spend about $35,000 a year on expenses.

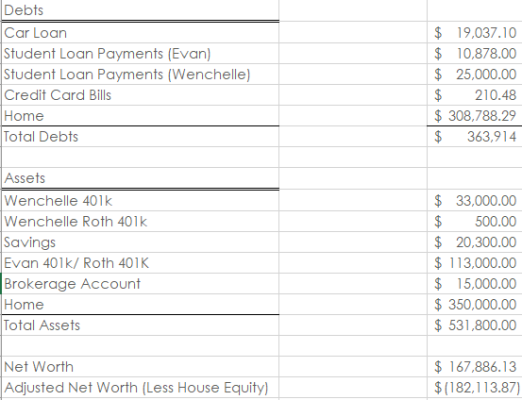

Assets:

401K: $110,000 (25% 401k, 75% Roth 401k) 88% Stocks, 12% Bonds. I put in around $5,600 annually

Personal Investment Accounts: $35,000 42% Stocks, 58% Cash. I deposit around $8,400 annually (all to stocks at the moment)

Debts:

Mortgage: $308,000 - Home value $340,000

Car: $19,000

Student Loans: $10,000 -Subsidized loans but in October 2021 the interest will kick in at 4.75%

I don't have credit card debt or accrue it.

I was also looking for advice on my student debts. I have a great job (technically two at the moment, income from second not included above) and don't see myself losing it anytime soon. I was thinking about paying off those debts from my savings and building it back up. My concern with that is that I am no longer putting money in my investment account for about a year.

I hope this information is helpful and I appreciate your time. If anyone would like to ask me a follow up question please do! I also do not mind being pointed towards an answer, any valuable resources would be great.

Thank you all!

I am looking to get some advice on some debts and if I am on track or not. I can mess around with financial calculators all day but, I'm looking for some advice and I am here to learn. Just finished reading "Your money or your life" and I'm going to be starting some financial habits outlined in the book.

I am 33, and looking to retire around 65 in 2053. I'm not in a rush to retire but, if I can make it happen sooner that would be great! I am looking to go back to school in the fall to pursue my Masters. This will add on about $35,000 in debt.

I earn $44,500K a year (after taxes) 55K before and spend about $35,000 a year on expenses.

Assets:

401K: $110,000 (25% 401k, 75% Roth 401k) 88% Stocks, 12% Bonds. I put in around $5,600 annually

Personal Investment Accounts: $35,000 42% Stocks, 58% Cash. I deposit around $8,400 annually (all to stocks at the moment)

Debts:

Mortgage: $308,000 - Home value $340,000

Car: $19,000

Student Loans: $10,000 -Subsidized loans but in October 2021 the interest will kick in at 4.75%

I don't have credit card debt or accrue it.

I was also looking for advice on my student debts. I have a great job (technically two at the moment, income from second not included above) and don't see myself losing it anytime soon. I was thinking about paying off those debts from my savings and building it back up. My concern with that is that I am no longer putting money in my investment account for about a year.

I hope this information is helpful and I appreciate your time. If anyone would like to ask me a follow up question please do! I also do not mind being pointed towards an answer, any valuable resources would be great.

Thank you all!

. I split my mortgage with my wife. We pay about $850 a person (including escrow). I have been debating about trading my car in especially since it is positive equity and getting a used car. I keep debating if the risks are worth it & what price point should my used car be, should I even create a payment or just pay off the used car.

. I split my mortgage with my wife. We pay about $850 a person (including escrow). I have been debating about trading my car in especially since it is positive equity and getting a used car. I keep debating if the risks are worth it & what price point should my used car be, should I even create a payment or just pay off the used car.