mtbikelover

Dryer sheet aficionado

- Joined

- Apr 15, 2019

- Messages

- 40

I'm 47, husband is 49, and we are planning to retire in a little less than 4 years. We have over $2M saved in investments (mix of roth, traditional IRA, and 401K). We also have about $450k in cash/quick access money. Most of that is earning 2-3% in short term CD's and money market accounts.

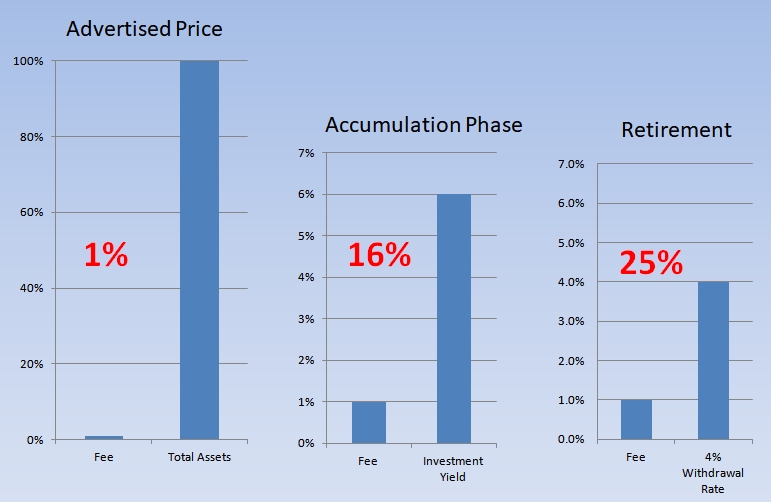

We pay a financial advisor to manage our investments and he is keeping $125k in cash - "waiting for something that is a good buy." It's killing me every time I look at the returns YTD and see 0.5% on those accounts and 12-14% on the accounts that are invested. It is in a money market account earning 2% but we pay him 1%.

I feel we should take the $125k and invest it in something like VTI or VFINX. If the market does tank and there are some good buys, we have plenty more cash to use to invest.

Would love to get others opinions.

Thanks!

We pay a financial advisor to manage our investments and he is keeping $125k in cash - "waiting for something that is a good buy." It's killing me every time I look at the returns YTD and see 0.5% on those accounts and 12-14% on the accounts that are invested. It is in a money market account earning 2% but we pay him 1%.

I feel we should take the $125k and invest it in something like VTI or VFINX. If the market does tank and there are some good buys, we have plenty more cash to use to invest.

Would love to get others opinions.

Thanks!