rworell

Dryer sheet aficionado

Wife and I are retired, I worked 30yrs at a jet engine manufacturer and my wife the same in insurance.

We presently work as work campers at campgrounds 6 months and travel in our RV the other 6 months. We have been able to earn enough to live from the 6 months of work. Now we would like to scale it back and pull from out retirement somehow and actually work less and travel more.

We are invested in a variable annuity presently. Now I realize and know all the wrongs of that and also understand the penalties to get out. I'm feeling like in some ways we made a bad decision. (it is what it is)... If I did get out from under it we would have about $675,000 to invest again. We live on about $28-$30 thousand a year and have "0" debt. I also have another $70,000 is cash for emergency. We would like to be able to invest, withdraw around our yearly expenditures and earn interest to never run out of money. We are not interested in making it big in the market or leaving a legacy. We just want to live simple for the next 30 yrs but always have money invested and to be able to pull from those investments.

We have no idea how that can happen. I've read where people do have index investments and pull off of dividends etc.

So glad we found this group. Thank you so much for any advice.

Richard and Kathi

We presently work as work campers at campgrounds 6 months and travel in our RV the other 6 months. We have been able to earn enough to live from the 6 months of work. Now we would like to scale it back and pull from out retirement somehow and actually work less and travel more.

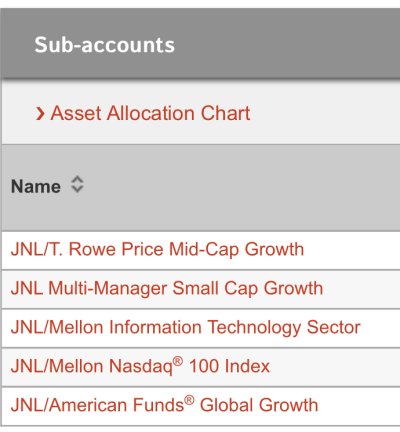

We are invested in a variable annuity presently. Now I realize and know all the wrongs of that and also understand the penalties to get out. I'm feeling like in some ways we made a bad decision. (it is what it is)... If I did get out from under it we would have about $675,000 to invest again. We live on about $28-$30 thousand a year and have "0" debt. I also have another $70,000 is cash for emergency. We would like to be able to invest, withdraw around our yearly expenditures and earn interest to never run out of money. We are not interested in making it big in the market or leaving a legacy. We just want to live simple for the next 30 yrs but always have money invested and to be able to pull from those investments.

We have no idea how that can happen. I've read where people do have index investments and pull off of dividends etc.

So glad we found this group. Thank you so much for any advice.

Richard and Kathi