hello,

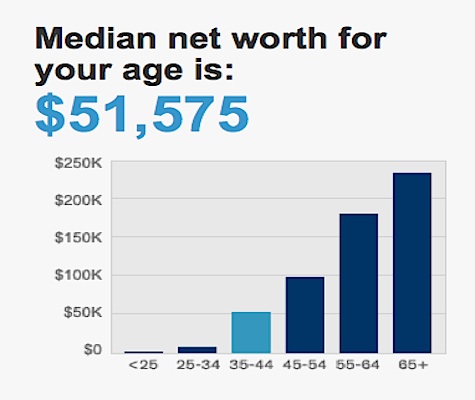

i've been going through the forums looking for a "where do i even begin?" faq. i thought i was doing pretty well compared to most Americans and vs. most of my friends, but you people seem to be doing amazingly well.

our house is paid off, worth $150-175k? no debt, no kids, 13 year-old car, 3-yr expenses cash emergency fund @ ~1%, DW & i have work pensions that won't kick in for 10-20 years depending on if either of us quit now vs. reaching basic retirement in 10 years. have only around 80k in 401k/roth ira. got started late on all things financial. i plan to leave the job i'm sick of to start online business selling our collections as we're borderline hoarders and have put a lot of our money into them and don't want to be too tied to them. wife will continue to work and she makes more than me, so she'll be eligible for pension sooner than me.

if SS won't kick in until around 2035 if ever, pension for me not until 2033, 401k/ira not eligible for unpenalized withdrawals till 2027; what's your recommendation for a kind of account i can put money into that will not have too much risk, but at least be likely to keep up with inflation that we can withdraw from earlier that age 59.5?

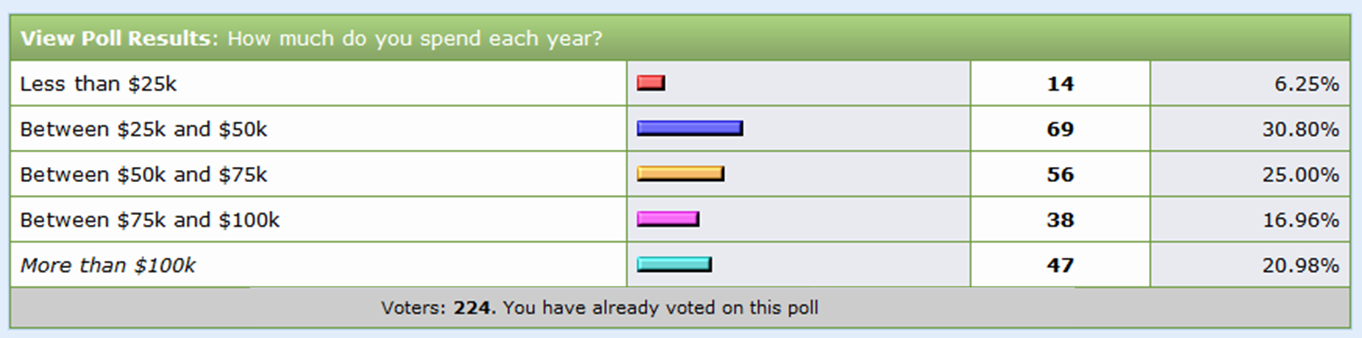

i thought we could live pretty frugally, but again, you guys seem like superheroes of saving/earning. of course i worry about health insurance costs when we leave our jobs as health insurance is already our biggest annual expense even though we're fairly healthy.

i've read what feels like quite a few personal finance books: Your Money or Your Life, Tyson's Personal Finance for Dummies, Tobias' Only Investment Guide You'll Ever Need, Millionaire Next Door, Rich Dad Poor Dad, etc., but investing still feels Greek to me. i wish things were as simple as in the original edition of YMoYL. i would appreciate any advice and links you might suggest. my parents were really bad with money so i felt like i had no context for this.

thanks and take care

i've been going through the forums looking for a "where do i even begin?" faq. i thought i was doing pretty well compared to most Americans and vs. most of my friends, but you people seem to be doing amazingly well.

our house is paid off, worth $150-175k? no debt, no kids, 13 year-old car, 3-yr expenses cash emergency fund @ ~1%, DW & i have work pensions that won't kick in for 10-20 years depending on if either of us quit now vs. reaching basic retirement in 10 years. have only around 80k in 401k/roth ira. got started late on all things financial. i plan to leave the job i'm sick of to start online business selling our collections as we're borderline hoarders and have put a lot of our money into them and don't want to be too tied to them. wife will continue to work and she makes more than me, so she'll be eligible for pension sooner than me.

if SS won't kick in until around 2035 if ever, pension for me not until 2033, 401k/ira not eligible for unpenalized withdrawals till 2027; what's your recommendation for a kind of account i can put money into that will not have too much risk, but at least be likely to keep up with inflation that we can withdraw from earlier that age 59.5?

i thought we could live pretty frugally, but again, you guys seem like superheroes of saving/earning. of course i worry about health insurance costs when we leave our jobs as health insurance is already our biggest annual expense even though we're fairly healthy.

i've read what feels like quite a few personal finance books: Your Money or Your Life, Tyson's Personal Finance for Dummies, Tobias' Only Investment Guide You'll Ever Need, Millionaire Next Door, Rich Dad Poor Dad, etc., but investing still feels Greek to me. i wish things were as simple as in the original edition of YMoYL. i would appreciate any advice and links you might suggest. my parents were really bad with money so i felt like i had no context for this.

thanks and take care